CarMax 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

OPERATIONS OUTLOOK

Store Openings and Capital Expenditures

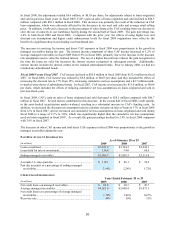

We currently estimate gross capital expenditures will total approximately $20 million in fiscal 2010, compared with

$185.7 million in fiscal 2009 and $253.1 million in fiscal 2008. This reduction reflects our decision to temporarily

suspend store growth and the related reduction in both construction and land purchases for future store openings. At

the date we announced the suspension, we had four stores under construction. We opened the store in Potomac

Mills, Virginia. The stores in Augusta, Georgia; Cincinnati, Ohio; and Dayton, Ohio, were substantially completed

at the end of fiscal 2009, but they will not be opened until market conditions improve. Until we resume store

growth, capital spending will be incurred primarily for maintenance capital items. Based on the relatively young

average age of our store base, maintenance capital has represented a very small portion of our total capital spending

in recent years.

Fiscal 2010 Expectations

As a result of the unprecedented declines in traffic and sales and the continuing volatility in the asset-backed

securitization market, we do not believe we can make a meaningful projection of fiscal 2010 sales or earnings.

However, assuming that sales trends do not improve from fourth quarter fiscal 2009 levels and given all of the

uncertainties in the economy, we would anticipate a double-digit decline in comparable store used unit sales in fiscal

2010, particularly early in the year.

Recent credit spreads in the public asset-backed securitization market have been significantly higher than the

spreads implicit in our warehouse facility. As a result, we estimate CAF income will be reduced by incremental

funding costs of between $60 million and $85 million before taxes, or $0.17 to $0.24 per share, upon refinancing the

$1.22 billion that was funded in the warehouse facility at the end of fiscal 2009. The Federal Reserve launched the

Term Asset-Backed Securities Loan Facility (“TALF”) program in March 2009, and it will continue through

December 2009, unless extended. The TALF program is intended to facilitate the issuance of asset-backed

securities and to improve market conditions for these securities. Prior to the launch of this program, there had been

minimal new issuances of automotive asset-backed securities for several months. In April 2009, we completed a

term securitization totaling $1.0 billion of auto loan receivables, which was eligible for investors to utilize the TALF

program.

Absent further substantial deterioration in sales and earnings, and given the assumptions set forth above, we believe

we will remain in compliance with our financial covenants in fiscal 2010.

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements applicable to CarMax, see Note 17.

FINANCIAL CONDITION

Liquidity and Capital Resources

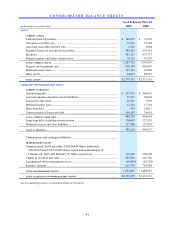

Operating Activities. We generated net cash from operating activities of $264.6 million in fiscal 2009, $79.5

million in fiscal 2008 and $136.8 million in fiscal 2007. Cash generated by operating activities was $185.1 million

higher in fiscal 2009 compared with fiscal 2008, primarily reflecting the significant decrease in inventory in fiscal

2009, partially offset by the decline in net earnings. Despite increasing our store base by 12%, we reduced

inventories 28%, or $272.6 million, in fiscal 2009 compared with an increase in inventory of $139.7 million in fiscal

2008. In fiscal 2009, we dramatically reduced our used vehicle inventory levels to bring them in line with the lower

sales rate. In fiscal 2008, the inventory increase reflected the combination of additional inventories needed to

support the expansion of our store base and the expansion of an “inventory up” test in select stores to determine

whether a modest expansion of onsite vehicle inventory, generally in the range of 50 to 100 cars per store, would

have a favorable effect on sales. Our retained interest in securitized receivables increased $77.5 million in fiscal

2009 compared with a $68.5 million increase in fiscal 2008. The fiscal 2009 growth reflected increases in the

required excess receivables and the amount of retained subordinated bonds we hold, partially offset by a decrease in

interest-only strip receivables.

Cash generated by operating activities was $57.3 million lower in fiscal 2008 compared with fiscal 2007. The

decrease resulted from a higher level of working capital investment in fiscal 2008, combined with the $16.6 million

decrease in net earnings. Our retained interest in securitized receivables increased $68.5 million in fiscal 2008