CarMax 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

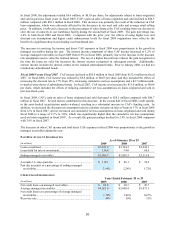

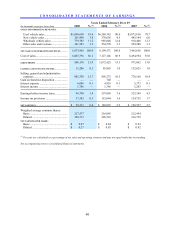

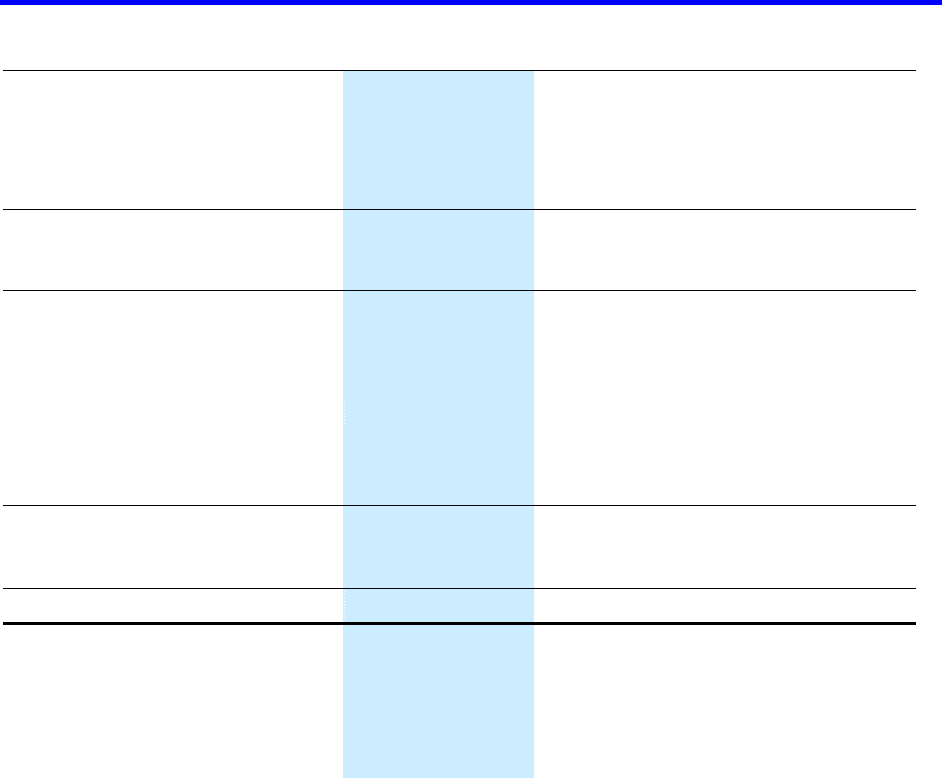

CONSOLIDATED STATEMENTS OF EARNINGS

Years Ended February 28 or 29

(In thousands except per share data) 2009 %

(1) 2008 %

(1) 2007 %

(1)

SALES AND OPERATING REVENUES:

Used vehicle sales ................................ $5,690,658 81.6 $ 6,589,342 80.4 $ 5,872,816 78.7

New vehicle sales................................. 261,940 3.8 370,603 4.5 445,144 6.0

Wholesale vehicle sales ....................... 779,785 11.2 985,048 12.0 918,408 12.3

Other sales and revenues...................... 241,583 3.5 254,578 3.1 229,288 3.1

NET SALES AND OPERATING REVENUES.......... 6,973,966 100.0 8,199,571 100.0 7,465,656 100.0

Cost of sales............................................. 6,005,796 86.1 7,127,146 86.9 6,494,594 87.0

GROSS PROFIT ............................................ 968,170 13.9 1,072,425 13.1 971,062 13.0

CARMAX AUTO FINANCE INCOME .................. 15,286 0.2 85,865 1.0 132,625 1.8

Selling, general and administrative

expenses ............................................... 882,358 12.7 858,372 10.5 776,168 10.4

Gain on franchise disposition .................. — — 740 — — —

Interest expense ....................................... 6,086 0.1 4,955 0.1 5,373 0.1

Interest income ........................................ 1,786 — 1,366 — 1,203 —

Earnings before income taxes.................. 96,798 1.4 297,069 3.6 323,349 4.3

Income tax provision ............................... 37,585 0.5 115,044 1.4 124,752 1.7

NET EARNINGS ............................................ $ 59,213 0.8 $ 182,025 2.2 $ 198,597 2.7

Weighted average common shares:

Basic..................................................... 217,537 216,045 212,454

Diluted ................................................. 220,513 220,522 216,739

NET EARNINGS PER SHARE:

Basic..................................................... $ 0.27 $ 0.84 $ 0.93

Diluted ................................................. $ 0.27 $ 0.83 $ 0.92

(1) Percents are calculated as a percentage of net sales and operating revenues and may not equal totals due to rounding.

See accompanying notes to consolidated financial statements.