CarMax 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

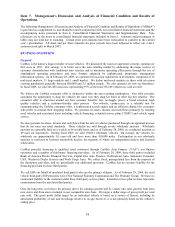

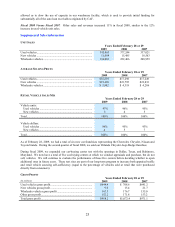

GAIN (LOSS) ON LOANS SOLD

Years Ended February 28 or 29

(In millions) 2009 2008 2007

Gain on sales of loans originated and sold (1) ........................... $ 46.5 $ 58.1 $ 86.7

Other (losses) gains(1) ............................................................... (81.8) (9.6) 13.0

Total (loss) gain........................................................................ $ (35.3) $ 48.5 $ 99.7

Loans originated and sold......................................................... $ 1,930.2 $ 2,430.8 $ 2,240.2

Receivables repurchased from term securitizations and

resold..................................................................................... 101.0 103.6 82.5

Total loans sold......................................................................... $ 2,031.2 $ 2,534.4 $ 2,322.7

Gain percentage on loans originated and sold .......................... 2.4% 2.4% 3.9%

Total (loss) gain as a percentage of total loans sold ................. (1.7)% 1.9% 4.3%

(1) To the extent we recognize valuation or other adjustments related to loans originated and sold during previous quarters of the

same fiscal year, the sum of amounts reported for the individual quarters may not equal the amounts reported for the

corresponding full fiscal year.

The gain on sales of loans originated and sold includes both the gain income recorded at the time of securitization

and the effect of any subsequent changes in valuation assumptions or funding costs that are incurred in the same

fiscal period that the loans were originated. Other losses or gains include the effects of changes in valuation

assumptions or funding costs related to loans originated and sold during previous fiscal periods. In addition, other

losses or gains could include the effects of new term securitizations, changes in the valuation of retained

subordinated bonds and the repurchase and resale of receivables in existing term securitizations, as applicable.

Our term securitizations typically contain an option to repurchase the securitized receivables when the outstanding

balance in the pool of auto loan receivables falls below 10% of the original pool balance. This option was exercised

two times in each of fiscal 2009, 2008 and 2007. In each case, the remaining eligible receivables were subsequently

resold into the warehouse facility. These transactions did not have a material effect on CAF income in fiscal 2009,

2008 or 2007. In future periods, the effects of refinancing, repurchase or resale activity could be favorable or

unfavorable, depending on the securitization structure and the market conditions at the transaction date.

Beginning in January 2008, we retained some or all of the subordinated bonds associated with our term

securitizations. These bonds were retained either because the economics of doing so were more favorable than

selling them or because there was no market for the subordinated bonds at the applicable issue date. The retained

subordinated bonds, which had total face values of $115 million and $44.7 million, respectively, at February 28,

2009, and February 29, 2008, are subject to mark-to-market adjustments.

Fiscal 2009 Versus Fiscal 2008. CAF income declined to $15.3 million in fiscal 2009 from $85.9 million in fiscal

2008. In both periods, CAF income was reduced by market-to-market write-downs and adjustments related to loans

originated in previous fiscal years. In fiscal 2009, these adjustments totaled $81.8 million, or $0.23 per share, and

they included:

• $32.0 million of mark-to-market write-downs in the carrying value of the subordinated bonds. The size of

the write-down reflected the illiquidity in the credit markets in fiscal 2009, particularly for subordinated

bonds. This non-cash charge primarily affects the timing of the recognition of CAF income. Assuming

current conditions persist, the mark-to-market write downs should reverse as we get closer to the maturity

dates of the underlying bonds, resulting in positive contributions to CAF income in future periods.

• $31.8 million for increases in cumulative net loss rate assumptions. The upper end of our cumulative net

loss rate assumption range was 4.0% at the end of fiscal 2009 versus 3.0% at the end of fiscal 2008.

• $18.0 million for increases in funding costs related to loans originated in prior fiscal years. The majority of

this increase related to loans that were securitized in the warehouse facility at the end of fiscal 2008 and

which were subsequently resold in term securitizations during fiscal 2009.

• $3.8 million for increasing the discount rate assumption to 19% from 17%.

• Partly offset by $3.8 million of net favorable adjustments primarily related to reducing our prepayment rate

assumption.