CarMax 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

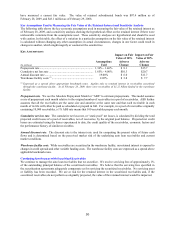

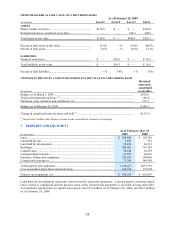

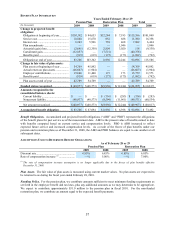

PAST DUE ACCOUNT INFORMATION

As of February 28 or 29

(In millions) 2009 2008 2007

Accounts 31+ days past due....................................................... $ 118.1 $ 86.1 $ 56.9

Ending managed receivables...................................................... $ 3,986.7 $ 3,838.5 $ 3,311.0

Past due accounts as a percentage of ending managed

receivables.............................................................................. 2.96% 2.24% 1.72%

CREDIT LOSS INFORMATION

Years Ended February 28 or 29

(In millions) 2009 2008 2007

Net credit losses on managed receivables.................................. $ 69.8 $ 38.3 $ 20.7

Average managed receivables ................................................... $4,021.0 $3,608.4 $ 3,071.1

Net credit losses as a percentage of average managed

receivables.............................................................................. 1.74% 1.06% 0.67%

Recovery rate............................................................................. 44% 50% 51%

SELECTED CASH FLOWS FROM SECURITIZED RECEIVABLES

Years Ended February 28 or 29

(In millions) 2009 2008 2007

Proceeds from new securitizations ............................................ $1,622.8 $2,040.2 $1,867.5

Proceeds from collections ......................................................... $ 840.6 $1,095.0 $1,011.8

Servicing fees received.............................................................. $ 41.3 $ 37.0 $ 32.0

Other cash flows received from the retained interest:

Interest-only strip receivables ................................................ $ 96.7 $ 98.6 $ 88.4

Reserve account releases........................................................ $ 6.4 $ 9.4 $ 15.2

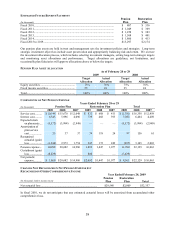

Proceeds from new securitizations. Proceeds from new securitizations include proceeds from receivables that are

newly securitized in or refinanced through the warehouse facility during the indicated period. Balances previously

outstanding in term securitizations that were refinanced through the warehouse facility totaled $101.0 million in

fiscal 2009, $103.6 million in fiscal 2008 and $82.5 million in fiscal 2007. Proceeds received when we refinance

receivables from the warehouse facility are excluded from this table as they are not considered new securitizations.

Proceeds from collections. Proceeds from collections represent principal amounts collected on receivables

securitized through the warehouse facility that are used to fund new originations.

Servicing fees received. Servicing fees received represent cash fees paid to us to service the securitized receivables.

Other cash flows received from the retained interest. Other cash flows received from the retained interest

represents cash that we receive from the securitized receivables other than servicing fees. It includes cash collected

on interest-only strip receivables and amounts released to us from reserve accounts.

Financial Covenants and Performance Triggers

The securitization agreement related to the warehouse facility includes various financial covenants and performance

triggers. The financial covenants include a maximum total liabilities to tangible net worth ratio and a minimum

fixed charge coverage ratio. Performance triggers require that the pool of securitized receivables in the warehouse

facility achieve specified thresholds related to portfolio yield, loss rate and delinquency rate. If these financial

covenants and/or thresholds are not met, we could be unable to continue to securitize receivables through the

warehouse facility. In addition, the warehouse facility investors could have us replaced as servicer and charge us a

higher rate of interest. Further, we could be forced to deposit collections on the securitized receivables with the

warehouse agent on a daily basis, deliver executed lockbox agreements to the warehouse facility agent and obtain a

replacement counterparty for the interest rate cap agreement related to the warehouse facility. As of February 28,

2009, we were in compliance with the financial covenants and the securitized receivables were in compliance with

the performance triggers.