CarMax 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

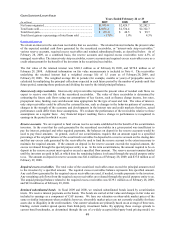

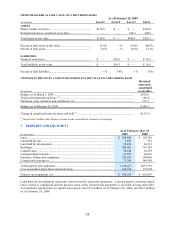

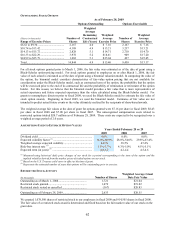

ESTIMATED FUTURE BENEFIT PAYMENTS

(In thousands)

Pension

Plan

Restoration

Plan

Fiscal 2010............................................................................................................... $ 807 $ 336

Fiscal 2011............................................................................................................... $ 1,049 $ 369

Fiscal 2012............................................................................................................... $ 1,258 $ 383

Fiscal 2013............................................................................................................... $ 1,508 $ 401

Fiscal 2014............................................................................................................... $ 1,800 $ 413

Fiscal 2015 to 2019.................................................................................................. $ 13,297 $ 2,174

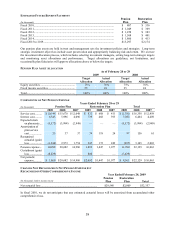

Our pension plan assets are held in trust and management sets the investment policies and strategies. Long-term

strategic investment objectives include asset preservation and appropriately balancing risk and return. We oversee

the investment allocation process, which includes selecting investment managers, setting long-term strategic targets

and monitoring asset allocations and performance. Target allocations are guidelines, not limitations, and

occasionally plan fiduciaries will approve allocations above or below the targets.

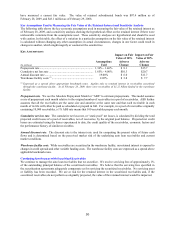

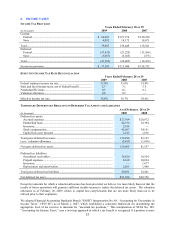

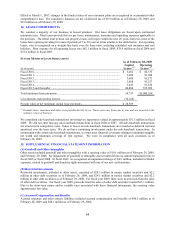

PENSION PLAN ASSET ALLOCATION

As of February 28 or 29

2009 2008

Target Actual Target Actual

Allocation Allocation Allocation Allocation

Equity securities ................................................ 75% 76% 75% 76%

Fixed income securities ..................................... 25 24 25 24

Total................................................................... 100% 100% 100% 100%

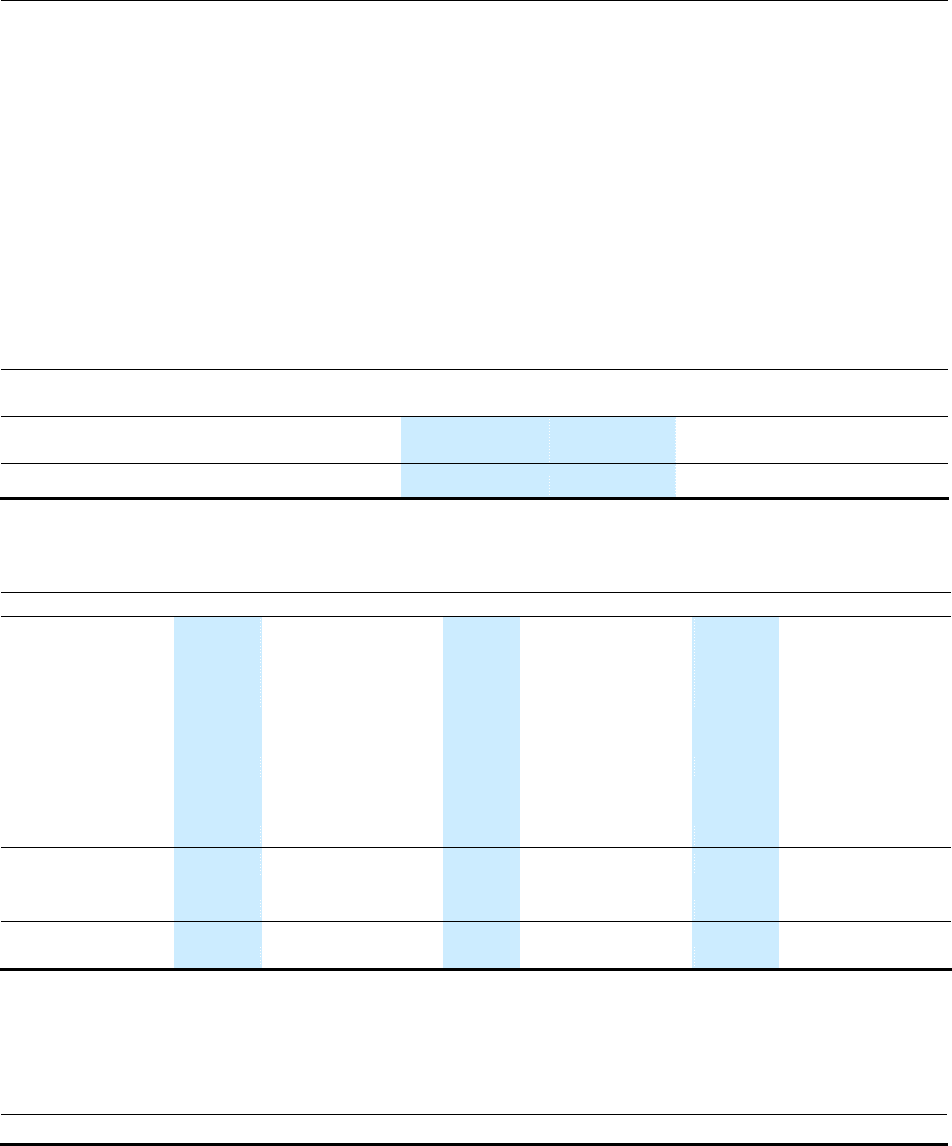

COMPONENTS OF NET PENSION EXPENSE

Years Ended February 28 or 29

(In thousands) Pension Plan Restoration Plan Total

2009 2008 2007 2009 2008 2007 2009 2008 2007

Service cost.......... $ 10,548 $ 15,670 $ 12,048 $ 832 $ 688 $ 411 $ 11,380 $ 16,358 $ 12,459

Interest cost.......... 6,343 5,996 4,096 739 468 393 7,082 6,464 4,489

Expected return

on plan assets .... (5,572) (3,994) (2,949) —— — (5,572) (3,994) (2,949)

Amortization of

prior service

cost ................. 23 37 37 74 119 24 97 156 61

Recognized

actuarial (gain)

loss ................. (1,244) 2,973 1,754 247 172 249 (997) 3,145 2,003

Pension expense... 10,098 20,682 14,986 1,892 1,447 1,077 11,990 22,129 16,063

Curtailment (gain)

loss ................. (8,229) — — 800 — — (7,429) — —

Net periodic

expense........... $ 1,869 $ 20,682 $ 14,986 $ 2,692 $ 1,447 $ 1,077 $ 4,561 $ 22,129 $ 16,063

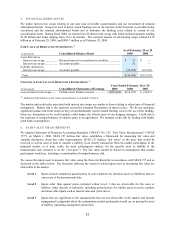

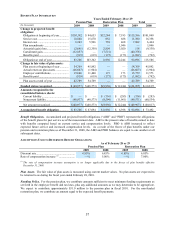

CHANGES NOT RECOGNIZED IN NET PENSION EXPENSE BUT

RECOGNIZED IN OTHER COMPREHENSIVE INCOME

Year Ended February 28, 2009

(In thousands, before income taxes)

Pension

Plan

Restoration

Plan Total

Net actuarial loss .............................................................................. $29,548 $2,809 $32,357

In fiscal 2010, we do not anticipate that any estimated actuarial losses will be amortized from accumulated other

comprehensive loss.