CarMax 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

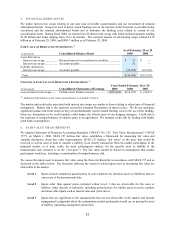

(B) Stock Incentive Plans

We maintain long-term incentive plans for management, key employees and the nonemployee members of our board

of directors. The plans allow for the grant of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock grants or a combination of

awards. To date, we have awarded no incentive stock options.

In fiscal 2006 and prior years, we primarily awarded stock options to employees who received share-based

compensation. Beginning in fiscal 2007, the majority of employees receiving awards now receive restricted stock

instead of stock options. Senior management continues to receive awards of nonqualified stock options.

Nonemployee directors continue to receive awards of nonqualified stock options and stock grants.

Stock options are awards that allow the recipient to purchase shares of our stock at a fixed price. Stock options are

granted at an exercise price equal to the fair market value of our stock on the grant date. Substantially all of the

stock options vest annually in equal amounts over periods of three to four years. These options expire no later than

ten years after the date of the grant. Restricted stock awards are subject to specified restrictions and a risk of

forfeiture. The restrictions typically lapse three years from the grant date.

As of February 28, 2009, a total of 34,500,000 shares of CarMax common stock have been authorized to be issued

under the long-term incentive plans. The number of unissued common shares reserved for future grants under the

long-term incentive plans was 5,182,895 as of February 28, 2009.

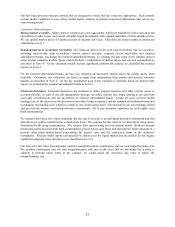

(C) Share-Based Compensation

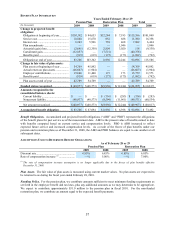

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

Years Ended February 28 or 29

(In thousands) 2009 2008 2007

Cost of sales............................................................................... $ 2,136 $ 1,945 $ 1,392

CarMax Auto Finance income................................................... 1,181 1,250 917

Selling, general and administrative expenses ............................ 33,201 31,487 30,379

Share-based compensation expense, before income taxes......... $ 36,518 $ 34,682 $ 32,688

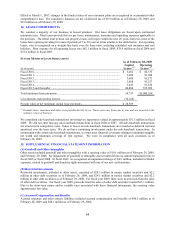

We recognize compensation expense for stock options and restricted stock on a straight-line basis (net of estimated

forfeitures) over the requisite service period, which is generally the vesting period of the award. Our employee

stock purchase plan is considered a liability-classified compensatory plan; the associated costs of $1.1 million in

fiscal 2009, $1.2 million in fiscal 2008 and $0.9 million in fiscal 2007 are included in share-based compensation

expense. There were no capitalized share-based compensation costs as of February 28, 2009, February 29, 2008,

and February 28, 2007.

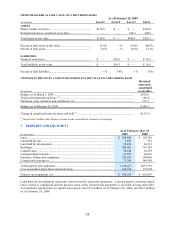

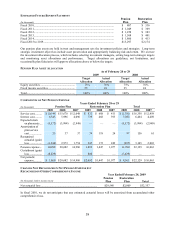

STOCK OPTION ACTIVITY

(Shares and intrinsic value in thousands)

Number of

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

Outstanding as of March 1, 2008...................... 13,648 $14.55

Options granted ................................................ 2,220 $19.56

Options exercised ............................................. (817) $12.47

Options forfeited or expired.............................. (207) $15.95

Outstanding as of February 28, 2009................ 14,844 $15.40 4.9 $2,213

Exercisable as of February 28, 2009................. 9,450 $13.17 4.5 $2,213

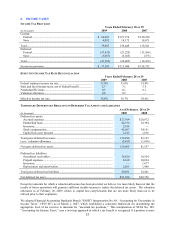

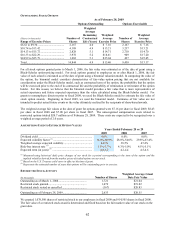

We granted nonqualified options to purchase 2,219,857 shares of common stock in fiscal 2009 and 1,882,183 shares

of common stock in fiscal 2008. The total cash received as a result of stock option exercises was $10.2 million in

fiscal 2009, $14.7 million in fiscal 2008 and $35.4 million in fiscal 2007. We settle stock option exercises with

authorized but unissued shares of CarMax common stock. The total intrinsic value of options exercised was $5.7

million for fiscal 2009, $26.8 million for fiscal 2008 and $74.7 million for fiscal 2007. We realized related tax

benefits of $2.2 million for fiscal 2009, $10.6 million for fiscal 2008 and $28.7 million for fiscal 2007.