CarMax 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

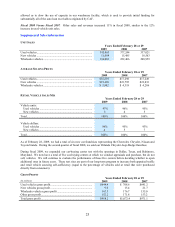

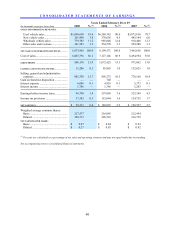

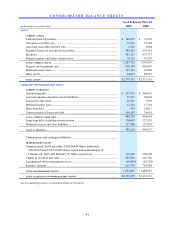

CONTRACTUAL OBLIGATIONS

As of February 28, 2009

(In millions)

Total

Less Than

1 Year

1 to 3

Years

3 to 5

Years

More

Than

5 Years Other

Revolving credit agreement (1)............... $ 308.5 $ — $ 308.5 $ — $ — $ —

Capital leases (2) ..................................... 58.7 3.5 7.2 7.2 40.8 —

Operating leases (2)................................. 1,004.3 82.3 163.3 162.8 595.9 —

Purchase obligations (3) .......................... 22.8 11.7 11.1 — — —

Asset retirement obligations (4) .............. 1.1 — — — 1.1 —

Defined benefit retirement plans (5) ....... 49.9 0.3 — — — 49.6

Unrecognized tax benefits (6) ................. 22.9 3.6 — — — 19.3

Total....................................................... $1,468.2 $ 101.4 $ 490.1 $170.0 $ 637.8 $ 68.9

(1) Due to the uncertainty of forecasting expected variable interest rate payments, those amounts are not included in the table. See

Note 10.

(2) Excludes taxes, insurance and other costs payable directly by us. These costs vary from year to year and are incurred in the

ordinary course of business. See Note 14.

(3) Includes certain enforceable and legally binding obligations related to the purchase of real property and third-party

outsourcing services.

(4) Represents the liability to retire signage, fixtures and other assets at certain leased locations.

(5) Represents the recognized funded status of our retirement plan, of which $49.6 million has no contractual payment schedule

and we expect payments to occur beyond 12 months from February 28, 2009. See Note 9.

(6) Represents the net unrecognized tax benefits related to uncertain tax positions. The timing of payments associated with $19.3

million of these tax benefits could not be estimated as of February 28, 2009. See Note 8.

Off-Balance Sheet Arrangements

CAF provides financing for a portion of our used and new car retail sales. We use a revolving securitization

program (“warehouse facility”) to fund substantially all of the auto loan receivables originated by CAF until they

can be funded through a term securitization or alternative funding arrangement. We sell the auto loan receivables to

a wholly owned, bankruptcy-remote, special purpose entity that transfers an undivided interest in the receivables to

entities formed by third-party investors.

Historically, we have used term securitizations to refinance the receivables previously securitized through the

warehouse facility. The purpose of term securitizations is to provide permanent funding for these receivables. In

these transactions, a pool of auto loan receivables is sold to a bankruptcy-remote, special purpose entity that in turn

transfers the receivables to a special purpose securitization trust.

Additional information regarding the nature, business purposes and importance of our off-balance sheet arrangement

to our liquidity and capital resources can be found in the CarMax Auto Finance Income, Financial Condition and

Market Risk sections of MD&A, as well as in Notes 3 and 4.