CarMax 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

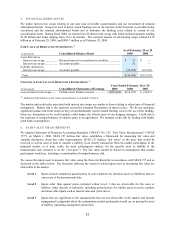

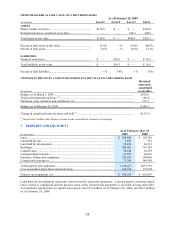

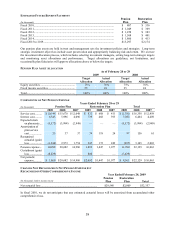

ASSUMPTIONS USED TO DETERMINE NET PENSION EXPENSE

Years Ended February 28 or 29

Pension Plan Restoration Plan

2009 2008 2007 2009 2008 2007

Discount rate (1)............................................... 6.85% 5.75% 5.75% 6.85% 5.75% 5.75%

Expected rate of return on plan assets ............ 8.00% 8.00% 8.00% — — —

Rate of compensation increase ....................... 5.00% 5.00% 5.00% 7.00% 7.00% 7.00%

(1) For fiscal 2009, a discount rate of 7.70% was used to determine the effects of the curtailment at October 21, 2008.

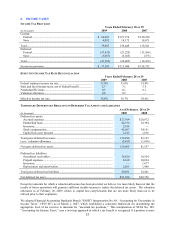

Assumptions. Underlying both the calculation of the PBO and the net pension expense are actuarial calculations of

each plan's liability. These calculations use participant-specific information such as salary, age and years of service,

as well as certain assumptions, the most significant being the discount rate, rate of return on plan assets, rate of

compensation increases and mortality rate. We evaluate these assumptions annually, at a minimum, and make

changes as necessary.

The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed

income debt instruments. For our plans, we review high quality corporate bond indices in addition to a hypothetical

portfolio of corporate bonds with maturities that approximate the expected timing of the anticipated benefit

payments.

To determine the expected long-term return on plan assets, we consider the current and anticipated asset allocations,

as well as historical and estimated returns on various categories of plan assets. We apply the estimated rate of return

to a market-related value of assets, which reduces the underlying variability in the asset values. The use of expected

long-term rates of return on pension plan assets could result in recognized asset returns that are greater or less than

the actual returns of those pension plan assets in any given year. Over time, however, the expected long-term

returns are anticipated to approximate the actual long-term returns, and therefore, result in a pattern of income and

expense recognition that more closely matches the pattern of the services provided by the employees. Differences

between actual and expected returns, a component of unrecognized actuarial gains/losses, are recognized over the

average future expected service of the active employees in the pension plan.

We determine the rate of compensation increases based upon our long-term plans for these increases. The rate of

compensation increases is no longer applicable for periods subsequent to December 31, 2008. Mortality rate

assumptions are based on the life expectancy of the population and were updated as of February 28, 2009, to account

for recent increases in life expectancy.

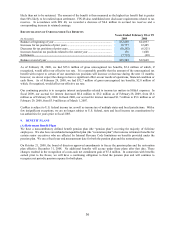

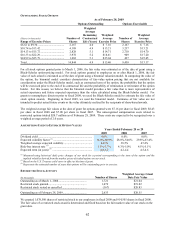

(B) Retirement Savings 401(k) Plan

We sponsor a 401(k) plan for all associates meeting certain eligibility criteria. In conjunction with the retirement

benefit plan curtailments, enhancements were made to the 401(k) plan effective January 1, 2009. The enhancements

increased the maximum salary contribution for eligible associates and increased our matching contribution.

Additionally, an annual company-funded contribution regardless of associate participation was implemented as well

as an additional company-funded contribution to those associates meeting certain age and service requirements. The

total cost for company contributions was $5.7 million in fiscal 2009, $3.2 million in fiscal 2008 and $2.7 million in

fiscal 2007.

(C) Retirement Restoration Plan

Effective January 1, 2009, we replaced the frozen restoration plan with a new non-qualified retirement plan for

certain associates who are affected by Internal Revenue Code limitations on benefits provided under the retirement

savings 401(k) plan. Under this plan, these associates may continue to defer portions of their compensation for

retirement savings. We match the associates’ contributions at the same rate provided under the 401(k) plan, and also

provide the annual company-funded contribution made regardless of associate participation, as well as the additional

company-funded contribution to the associates meeting the same age and service requirements. This plan is

unfunded with lump sum payments to be made upon the associate’ s retirement. The total cost for this plan was

immaterial in fiscal 2009.