CarMax 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

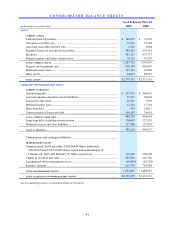

compared with a $44.0 million increase in fiscal 2007. The fiscal 2008 increase reflected our decision to retain

$44.7 million face value of subordinated bonds in the January 2008 term securitization and the growth in the total

managed receivables. Inventories increased 17%, or $139.7 million, in fiscal 2008, which was greater than our 10%

increase in vehicle revenues. The growth in inventories resulted from the increase in our store base and from the

“inventory up” test. In the fourth quarter of fiscal 2008, this test was being conducted in approximately 30% of our

stores.

The aggregate principal amount of outstanding auto loan receivables funded through securitizations, which are

discussed in Notes 3 and 4, totaled $3.83 billion as of February 28, 2009; $3.76 billion as of February 29, 2008; and

$3.24 billion as of February 28, 2007. During fiscal 2009, we completed two term securitizations of auto loan

receivables, including $750 million in May 2008 and $525 million in July 2008. We retained a total of $70.3

million face value of subordinated bonds in these two securitizations. During fiscal 2008, we completed three term

securitizations, funding a total of $1.78 billion of auto loan receivables. In the term securitization in January 2008,

we retained $44.7 million face value of subordinated bonds.

As of February 28, 2009, the warehouse facility limit was $1.4 billion. At that date, $1.22 billion of auto loan

receivables were funded in the warehouse facility and unused warehouse capacity totaled $185 million. As of the

beginning of fiscal 2009, the warehouse facility limit had been temporarily increased to $1.3 billion from $1.0

billion. During fiscal 2009, we increased the facility limit to $1.4 billion. The warehouse facility has an annual

term and it expires in July 2009. We intend to enter into new, or renew or expand existing funding arrangements to

meet CAF’ s future funding needs. However, based on conditions in the credit markets, the cost and credit

enhancements for these arrangements could be materially higher than historical levels and the timing and capacity of

these transactions could be dictated by market availability rather than our requirements. Note 4 includes additional

discussion of the warehouse facility.

Investing Activities. Net cash used in investing activities was $155.3 million in fiscal 2009, $257.0 million in fiscal

2008 and $187.2 million in fiscal 2007. Capital expenditures were $185.7 million in fiscal 2009, $253.1 million in

fiscal 2008 and $191.8 million in fiscal 2007. In addition to store construction costs, capital expenditures for fiscal

2008 and fiscal 2007 included the cost of land acquired for future year store openings. The decline in capital

spending in fiscal 2009 reflected our decision in December 2008 to temporarily suspend store growth.

Historically, capital expenditures have been funded with internally generated funds, long-term debt and sale-

leaseback transactions. Net proceeds from the sales of assets totaled $34.3 million in fiscal 2009, $1.1 million in

fiscal 2008 and $4.6 million in fiscal 2007. During fiscal 2009, we completed sale-leaseback transactions for our

two used car superstores in Austin, Texas valued at $31.3 million.

As of February 28, 2009, we owned our home office in Richmond, Virginia, 41 used car superstores currently in

operation and the three superstores that have been substantially completed, but which will not be opened until

market conditions improve. In addition, five superstores were accounted for as capital leases.

Financing Activities. Net cash provided by financing activities totaled $18.4 million in fiscal 2009, $171.0 million

in fiscal 2008 and $48.1 million in fiscal 2007. During the second half of fiscal 2009, due to the unprecedented

conditions in the credit markets, we believed that it was prudent to maintain a higher-than-normal cash balance. As

of February 28, 2009, we had cash and cash equivalents of $140.6 million compared with $13.0 million as of

February 29, 2008, and $19.5 million as of February 28, 2007. Despite the increase in cash and the decline in

earnings in fiscal 2009, total debt increased by only $7.8 million to $337.0 million as of February 28, 2009,

primarily due to our significant reductions in inventory. In fiscal 2008, we increased total debt by $148.9 million,

primarily to fund increased inventory and capital expenditures. In fiscal 2007, we used cash generated from

operations to reduce total debt by $9.5 million.

During fiscal 2009, we increased the aggregate borrowing limit under our revolving credit facility by $200 million

to a total of $700 million. The credit facility expires in December 2011 and is secured by our vehicle inventory.

Borrowings under this credit facility are limited to 80% of qualifying inventory, and they are available for working

capital and general corporate purposes. As of February 28, 2009, $308.5 million was outstanding under the credit

facility and $227.7 million of the remaining balance was available to us. The outstanding balance under the facility

included $0.9 million classified as short-term debt, $157.6 million classified as current portion of long-term debt and

$150.0 million classified as long-term debt. We classified $157.6 million of the outstanding balance as of

February 29, 2008, as current portion of long-term debt based on our expectation that this balance will not remain

outstanding for more than one year.