CarMax 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

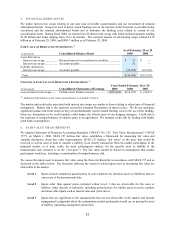

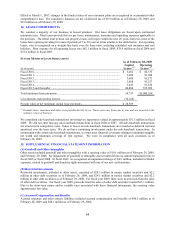

likely than not to be sustained. The amount of the benefit is then measured as the highest tax benefit that is greater

than 50% likely to be realized upon settlement. FIN 48 also established new disclosure requirements related to tax

reserves. In accordance with FIN 48, we recorded a decrease of $0.4 million in accrued tax reserves and a

corresponding increase in retained earnings.

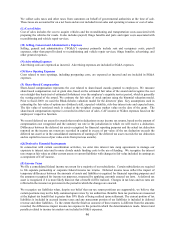

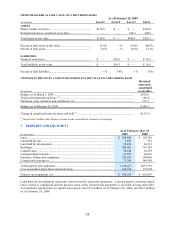

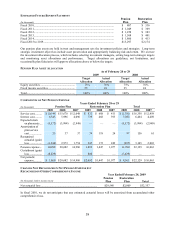

RECONCILIATION OF UNRECOGNIZED TAX BENEFITS

Years Ended February 28 or 29

(In thousands) 2009 2008

Balance at beginning of year ................................................................................ $32,669 $24,957

Increases for tax positions of prior years.............................................................. 10,757 12,485

Decreases for tax positions of prior years............................................................. (10,265) (6,321)

Increases based on tax positions related to the current year ................................. 136 1,608

Settlements ........................................................................................................... (7,713) (60)

Balance at end of year .......................................................................................... $25,584 $32,669

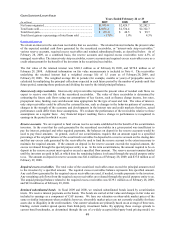

As of February 28, 2009, we had $25.6 million of gross unrecognized tax benefits, $2.6 million of which, if

recognized, would affect our effective tax rate. It is reasonably possible that the amount of the unrecognized tax

benefit with respect to certain of our uncertain tax positions will increase or decrease during the next 12 months;

however, we do not expect the change to have a significant effect on our results of operations, financial condition or

cash flows. As of February 29, 2008, we had $32.7 million of gross unrecognized tax benefits, $2.8 million of

which, if recognized, would affect our effective tax rate.

Our continuing practice is to recognize interest and penalties related to income tax matters in SG&A expenses. In

fiscal 2009, our accrual for interest decreased $0.4 million to $5.2 million as of February 28, 2009, from $5.6

million as of February 29, 2008. In fiscal 2008, our accrual for interest increased $1.7 million to $5.6 million as of

February 29, 2008, from $3.9 million as of March 1, 2007.

CarMax is subject to U.S. federal income tax as well as income tax of multiple states and local jurisdictions. With a

few insignificant exceptions, we are no longer subject to U.S. federal, state and local income tax examinations by

tax authorities for years prior to fiscal 2003.

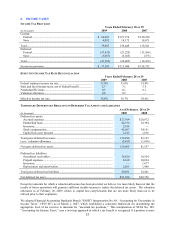

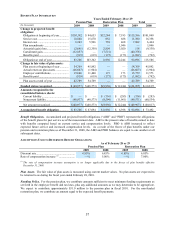

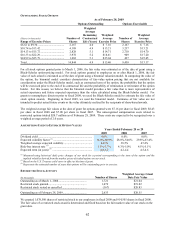

9. BENEFIT PLANS

(A) Retirement Benefit Plans

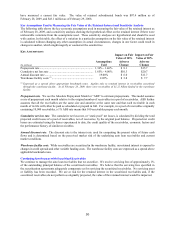

We have a noncontributory defined benefit pension plan (the “pension plan”) covering the majority of full-time

employees. We also have an unfunded nonqualified plan (the “restoration plan”) that restores retirement benefits for

certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the

pension plan. We use a fiscal year end measurement date for both the pension plan and the restoration plan.

On October 21, 2008, the board of directors approved amendments to freeze the pension plan and the restoration

plan effective December 31, 2008. No additional benefits will accrue under these plans after that date. These

changes resulted in the recognition of a non-cash net curtailment gain of $7.4 million. In connection with benefits

earned prior to the freeze, we will have a continuing obligation to fund the pension plan and will continue to

recognize net periodic pension expense for both plans.