CarMax 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities.

Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol KMX.

As of February 28, 2009, there were approximately 7,000 CarMax shareholders of record.

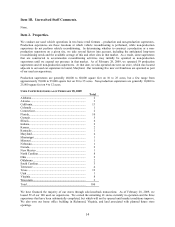

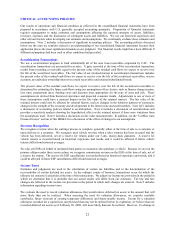

The following table sets forth for the fiscal periods indicated, the high and low sales prices per share for our

common stock, as reported on the New York Stock Exchange composite tape and adjusted for the effect of the

2-for-1 stock split in March 2007.

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal 2009

High ................................................... $21.99 $19.95 $20.70 $10.38

Low .................................................... $17.30 $10.53 $ 5.76 $ 6.59

Fiscal 2008

High ................................................... $27.75 $27.42 $25.38 $23.47

Low .................................................... $22.63 $20.33 $18.67 $15.81

To date, we have not paid a cash dividend on CarMax common stock. In the near term, we believe it is prudent to

retain our net earnings for use in operations and to maintain maximum financial flexibility and liquidity for our

business. Longer term, we intend to continue to retain our net earnings for use in operations and, when we resume

our store growth plan, for geographic expansion. Therefore, we do not anticipate paying any cash dividends in the

foreseeable future.

During the fourth quarter of fiscal 2009, we sold no CarMax equity securities that were not registered under the

Securities Act of 1933, as amended. In addition, we did not repurchase any CarMax equity securities during this

period.

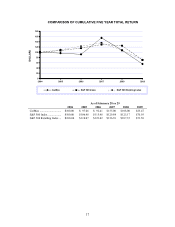

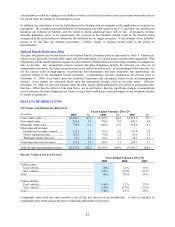

Performance Graph

The following graph compares the five-year cumulative total return among CarMax common stock, the S&P 500

Index and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in our common stock

and in each index on February 28, 2004, and the reinvestment of dividends, if applicable.