CarMax 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

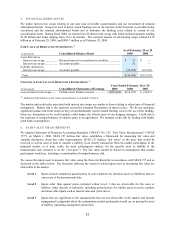

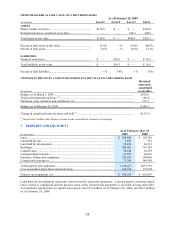

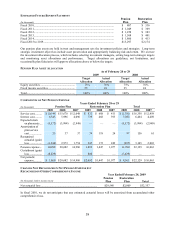

ITEMS MEASURED AT FAIR VALUE ON A RECURRING BASIS

As of February 28, 2009

(In millions) Level 1 Level 2 Level 3 Total

ASSETS

Money market securities.......................................................... $156.8 $ — $ — $156.8

Retained interest in securitized receivables ............................. — — 348.3 348.3

Total assets at fair value .......................................................... $156.8 $ — $348.3 $505.1

Percent of total assets at fair value........................................... 31.0% — % 69.0% 100.0%

Percent of total assets .............................................................. 6.6% — % 14.6% 21.2%

LIABILITIES

Financial derivatives................................................................ $ — $ 30.5 $ — $ 30.5

Total liabilities at fair value..................................................... $ — $ 30.5 $ — $ 30.5

Percent of total liabilities......................................................... — % 3.9% — % 3.9%

CHANGES IN THE LEVEL 3 ASSETS MEASURED AT FAIR VALUE ON A RECURRING BASIS

(In millions)

Retained

interest in

securitized

receivables

Balance as of March 1, 2009 .............................................................................................................. $ 270.8

Total realized/unrealized losses (1) ...................................................................................................... (46.4)

Purchases, sales, issuances and settlements, net ................................................................................. 123.9

Balance as of February 28, 2009 ........................................................................................................ $ 348.3

Change in unrealized losses on assets still held (1).............................................................................. $ (33.5)

(1) Reported in CarMax Auto Finance income on the consolidated statements of earnings.

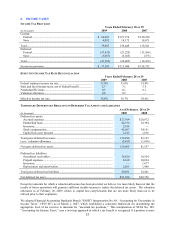

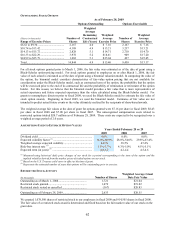

7. PROPERTY AND EQUIPMENT

As of February 28 or 29

(In thousands) 2009 2008

Land........................................................................................................................ $ 198,809 $ 162,786

Land held for sale ................................................................................................... 1,432 921

Land held for development..................................................................................... 38,200 42,311

Buildings................................................................................................................. 509,682 397,183

Capital leases .......................................................................................................... 30,640 29,258

Leasehold improvements........................................................................................ 83,823 64,947

Furniture, fixtures and equipment........................................................................... 230,552 199,996

Construction in progress......................................................................................... 71,289 140,389

Total property and equipment................................................................................. 1,164,427 1,037,791

Less accumulated depreciation and amortization ............................................................. 226,168 175,294

Property and equipment, net................................................................................... $ 938,259 $ 862,497

Land held for development represents land owned for potential expansion. Leased property meeting capital

lease criteria is capitalized and the present value of the related lease payments is recorded as long-term debt.

Accumulated amortization on capital lease assets was $7.9 million as of February 28, 2009, and $6.2 million

as of February 29, 2008.