CarMax 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

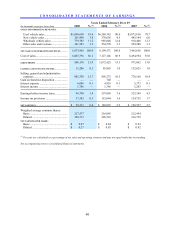

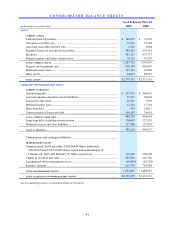

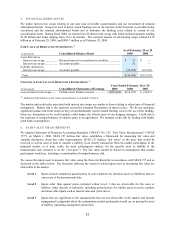

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Accumulated

Common Capital in Other

Shares Common Excess of Retained Comprehensive

(In thousands) Outstanding Stock Par Value Earnings Loss Total

BALANCE AS OF FEBRUARY 28, 2006 ..................

.

209,910 $104,954 $501,599 $373,550 $ 980,103

Net earnings ...................................... — — — 198,597 198,597

Adjustment to initially apply SFAS

No. 158, net of taxes of $11,858.... — — — — $ (20,332) (20,332)

Share-based compensation

expense for stock options and

restricted stock............................... — — 31,526 — — 31,526

Exercise of common stock options.... 5,280 2,640 34,383 — — 37,023

Shares issued under stock

incentive plans............................... 1,002 502 (201) — — 301

Shares cancelled upon

reacquisition .................................. (164) (82) (1,531) — — (1,613)

Tax benefit from the exercise of

common stock options................... — — 21,770 — — 21,770

BALANCE AS OF FEBRUARY 28, 2007 ..................

.

216,028 108,014 587,546 572,147 (20,332) 1,247,375

Comprehensive income:

Net earnings................................... — — — 182,025 — 182,025

Retirement benefit plans, net of

taxes of $2,091 ......................... — — — — 3,604 3,604

Total comprehensive income......... 185,629

Adjustment to initially apply

FIN 48 ........................................... — — — 408 — 408

Share-based compensation

expense for stock options and

restricted stock............................... — — 33,146 — — 33,146

Exercise of common stock options.... 1,774 887 13,854 — — 14,741

Shares issued under stock

incentive plans............................... 927 463 (148) — — 315

Shares cancelled upon

reacquisition .................................. (113) (56) 45 — — (11)

Tax benefit from the exercise of

common stock options................... — — 7,323 — — 7,323

BALANCE AS OF FEBRUARY 29, 2008 ..................

.

218,616 109,308 641,766 754,580 (16,728) 1,488,926

Comprehensive income:

Net earnings................................... — — — 59,213 — 59,213

Retirement benefit plans, net of

taxes of $176 ............................ — — — — (132) (132)

Total comprehensive income......... 59,081

Share-based compensation

expense for stock options and

restricted stock............................... — — 34,854 — — 34,854

Exercise of common stock options.... 817 408 9,778 — — 10,186

Shares issued under stock

incentive plans............................... 1,119 560 40 — — 600

Shares cancelled upon

reacquisition .................................. (160) (80) 40 — — (40)

Tax effect from the exercise of

common stock options................... — — (540) — — (540)

BALANCE AS OF FEBRUARY 28, 2009 ............. 220,392 $110,196 $685,938 $ 813,793 $ (16,860) $1,593,067

See accompanying notes to consolidated financial statements.