CarMax 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

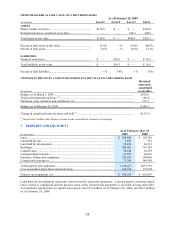

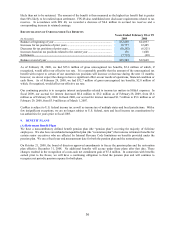

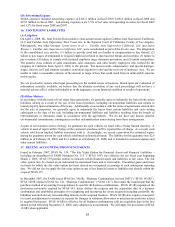

OUTSTANDING STOCK OPTIONS

As of February 28, 2009

Options Outstanding Options Exercisable

(Shares in thousands)

Range of Exercise Prices

Number of

Shares

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise Price

Number of

Shares

Weighted

Average

Exercise Price

$6.62 to $9.30..................................... 2,167 4.0 $ 7.16 2,167 $ 7.16

$10.74 to $13.42 ................................. 4,189 4.9 $ 13.21 3,237 $ 13.21

$14.13 to $15.72 ................................. 2,828 5.1 $ 14.71 2,710 $ 14.70

$16.33 to $22.29 ................................. 3,978 5.2 $18.61 909 $ 17.20

$24.99 to $25.79 ................................. 1,682 5.1 $ 25.04 427 $ 25.05

Total.................................................... 14,844 4.9 $ 15.40 9,450 $ 13.17

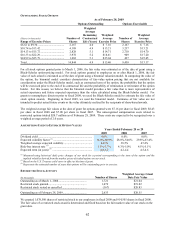

For all stock options granted prior to March 1, 2006, the fair value was estimated as of the date of grant using a

Black-Scholes option-pricing model. For stock options granted to employees on or after March 1, 2006, the fair

value of each award is estimated as of the date of grant using a binomial valuation model. In computing the value of

the option, the binomial model considers characteristics of fair-value option pricing that are not available for

consideration under the Black-Scholes model, such as contractual term of the option, the probability that the option

will be exercised prior to the end of its contractual life and the probability of termination or retirement of the option

holder. For this reason, we believe that the binomial model provides a fair value that is more representative of

actual experience and future expected experience than the value calculated using the Black-Scholes model. For

grants to nonemployee directors prior to fiscal 2009, we used the Black-Scholes model to estimate the fair value of

stock option awards. Beginning in fiscal 2009, we used the binomial model. Estimates of fair value are not

intended to predict actual future events or the value ultimately realized by the recipients of share-based awards.

The weighted average fair values at the date of grant for options granted were $7.16 per share in fiscal 2009, $8.43

per share in fiscal 2008 and $7.08 per share in fiscal 2007. The unrecognized compensation costs related to

nonvested options totaled $20.7 million as of February 28, 2009. These costs are expected to be recognized over a

weighted average period of 2.0 years.

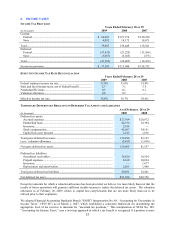

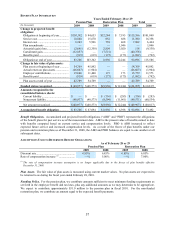

ASSUMPTIONS USED TO ESTIMATE OPTION VALUES

Years Ended February 28 or 29

2009 2008 2007

Dividend yield ........................................................................... 0.0% 0.0% 0.0%

Expected volatility factor (1) ...................................................... 34.8%-60.9% 28.0%-54.0% 29.8%-63.4%

Weighted average expected volatility........................................ 44.1% 38.5% 47.4%

Risk-free interest rate (2) ............................................................ 1.5%-3.7% 4.3%-5.0% 4.5%-5.1%

Expected term (in years) (3) ....................................................... 4.8-5.2 4.2-4.4 4.5-4.6

(1) Measured using historical daily price changes of our stock for a period corresponding to the term of the option and the

implied volatility derived from the market prices of traded options on our stock.

(2) Based on the U.S. Treasury yield curve in effect at the time of grant.

(3) Represents the estimated number of years that options will be outstanding prior to exercise.

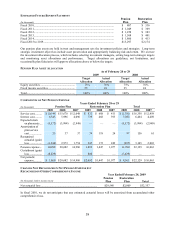

RESTRICTED STOCK ACTIVITY

(In thousands) Number of Shares

Weighted Average Grant

Date Fair Value

Outstanding as of March 1, 2008....................................... 1,721 $21.04

Restricted stock granted..................................................... 1,079 $19.82

Restricted stock vested or cancelled .................................. (167) $20.83

Outstanding as of February 28, 2009................................. 2,633 $20.55

We granted 1,078,580 shares of restricted stock to our employees in fiscal 2009 and 914,505 shares in fiscal 2008.

The fair value of a restricted stock award is determined and fixed based on the fair market value of our stock on the

grant date.