CarMax 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

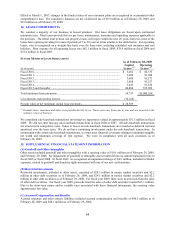

The unrecognized compensation costs related to nonvested restricted stock awards totaled $19.3 million as of

February 28, 2009. These costs are expected to be recognized over a weighted average period of 1.2 years.

(D) Employee Stock Purchase Plan

We sponsor an employee stock purchase plan for all associates meeting certain eligibility criteria. Associate

contributions are limited to 10% of eligible compensation, up to a maximum of $7,500 per year. For each $1.00

contributed by associates to the plan, we match $0.15. We have authorized up to 4,000,000 shares of common stock

for the employee stock purchase plan. Shares are acquired through open-market purchases.

As of February 28, 2009, a total of 1,180,195 shares remained available under the plan. Shares purchased on the

open market on behalf of associates totaled 677,944 during fiscal 2009; 409,004 during fiscal 2008; and 337,311

during fiscal 2007. The average price per share for purchases under the plan was $12.22 in fiscal 2009, $22.24 in

fiscal 2008 and $19.32 in fiscal 2007. The total cost for matching contributions was $1.1 million in fiscal 2009, $1.2

million in fiscal 2008 and $0.9 million in fiscal 2007. These costs are included in share-based compensation

expense.

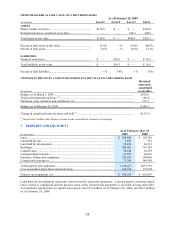

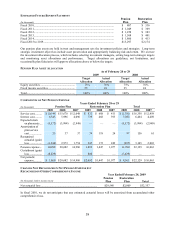

12. NET EARNINGS PER SHARE

BASIC AND DILUTIVE NET EARNINGS PER SHARE RECONCILIATIONS

Years Ended February 28 or 29

(In thousands except per share data) 2009 2008 2007

Net earnings available to common shareholders .............................. $ 59,213 $ 182,025 $ 198,597

Weighted average common shares outstanding........................ 217,537 216,045 212,454

Dilutive potential common shares:

Stock options......................................................................... 1,820 3,918 4,111

Restricted stock..................................................................... 1,156 559 174

Weighted average common shares and dilutive potential

common shares.................................................................... 220,513 220,522 216,739

Basic net earnings per share.................................................... $ 0.27 $ 0.84 $ 0.93

Diluted net earnings per share................................................. $ 0.27 $ 0.83 $ 0.92

For fiscal 2009, weighted-average options to purchase 8,340,996 shares of common stock were outstanding and not

included in the calculation of diluted net earnings per share because their inclusion would be antidilutive. For fiscal

2008, weighted-average options to purchase 1,586,357 shares of common stock were outstanding and not included

in the calculation. For fiscal 2007, weighted-average options to purchase 1,421,999 were outstanding and not

included in the calculation.

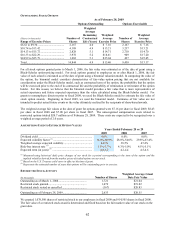

13. ACCUMULATED OTHER COMPREHENSIVE LOSS

Years Ended February 28 or 29

(In thousands, net of income taxes)

Unrecognized

Actuarial Losses

(Gains)

Unrecognized

Prior Service Cost

Total

Accumulated

Other

Comprehensive

Loss

Balance as of February 28, 2006 ...........................

.

$ — $ — $ —

Adoption of SFAS 158..........................................

.

20,094 238 20,332

Balance as of February 28, 2007 ...........................

.

20,094 238 20,332

Amounts arising during the year ...........................

.

(2,177) 662 (1,515)

Amortization recognized in net pension expense..

.

(1,991) (98) (2,089)

Balance as of February 29, 2008 ...........................

.

15,926 802 16,728

Amounts arising during the year ...........................

.

20,363 — 20,363

Amortization recognized in net pension expense..

.

604 (65) 539

Curtailment of retirement benefit plans.................

.

(20,033) (737) (20,770)

Balance as of February 28, 2009 ...........................

.

$ 16,860 $ — $ 16,860