Blackberry 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

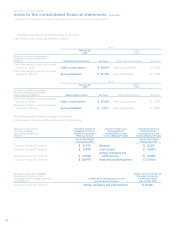

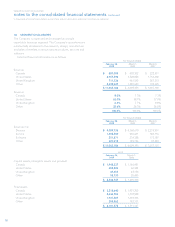

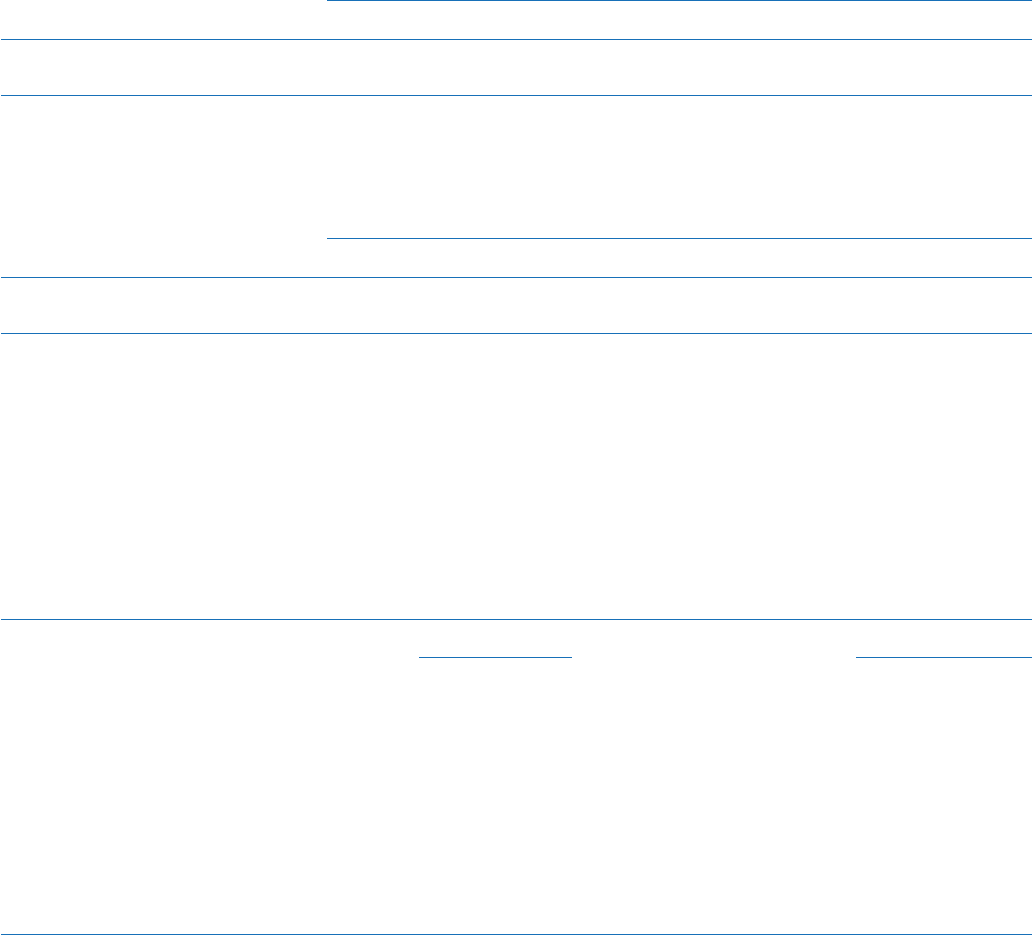

The following tables show the fair values of derivative

instruments in the consolidated balance sheets.

As at

February 28,

2009 March 1,

2008

Derivative instruments designated as

hedging instruments as defined in

SFAS 133 Balance Sheet Classification Fair Value Balance Sheet Classification Fair Value

Cash flow hedges, currency forward

contracts - asset Other current assets $ 48,074 Other current assets $ 46,302

Cash flow hedges, currency forward

contracts - liability Accrued liabilities $ 50,756 Accrued liabilities $ 11,708

As at

February 28,

2009 March 1,

2008

Derivative instruments that do not

meet the requirements for hedge

accounting under SFAS 133 Balance Sheet Location Fair Value Balance Sheet Location Fair Value

Economic hedges, currency forward

contracts - asset Other current assets $ 22,026 Other current assets $ 1,205

Economic hedges, currency forward

contracts - liability Accrued liabilities $ 6,071 Accrued liabilities $ 8,085

The following tables show the impact of derivative

instruments on the consolidated statements of operations.

Derivative Instruments in

Cash Flow Hedging

Relationships as defined in

SFAS 133

Amount of Gain (Loss)

Recognized in OCI on

Derivative Instruments

(Effective Portion)

Location of Gain (Loss)

Reclassified from

Accumulated OCI into

Income (Effective Portion)

Amount of Gain (Loss)

Reclassified from

Accumulated OCI into

Income (Effective Portion)

For the Year Ended

February 28, 2009 For the Year Ended

February 28, 2009

Currency Forward Contracts $ 47,272 Revenue $ 43,212

Currency Forward Contracts $ (9,991) Cost of sales $ (4,425)

Currency Forward Contracts $ (14,986) Selling, marketing and

administration $ (6,638)

Currency Forward Contracts $ (24,977) Research and development $ (11,063)

Derivative Instruments in Hedging

Relationships that do not meet

the requirements for hedge accounting

under SFAS 133 Location of Gain Recognized in Income

on Derivative Instruments

Amount of Gain in Income on

Derivative Instruments

For the Year Ended

February 28, 2009

Currency Forward Contracts Selling, marketing and administration $ 24,782