Blackberry 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

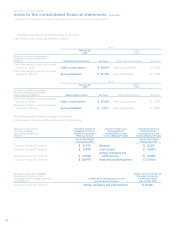

February 28, 2009

Assets (Liabilities) Notional

Amount Carrying

Amount Estimated

Fair Value

Cash and cash equivalents $ - $ 835,546 $ 835,546

Available-for-sale investments $ - $ 1,398,104 $ 1,398,104

Currency forward contracts - asset $ 1,147,709 $ 70,100 $ 70,100

Currency forward contracts - liability $ 975,543 $ (56,827) $ (56,827)

March 1, 2008

Assets (Liabilities) Notional

Amount Carrying

Amount Estimated

Fair Value

Cash and cash equivalents $ - $ 1,184,398 $ 1,184,398

Available-for-sale investments $ - $ 1,154,098 $ 1,154,098

Long-term debt $ - $ (7,608) $ (7,830)

Currency forward contracts - asset $ 991,884 $ 47,507 $ 47,507

Currency forward contracts - liability $ 699,821 $ (19,793) $ (19,793)

Selling, marketing and administration expense for the fiscal

year includes a foreign currency exchange loss of $6.1 million

(March 1, 2008 – loss of $5.3 million; March 3, 2007 – loss of

$2.0 million).

17. FINANCIAL INSTRUMENTS

Values of financial instruments outstanding were as follows:

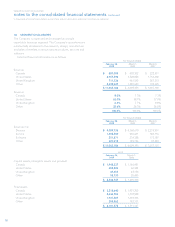

(b) Certain statement of cash flow information related to

interest and income taxes paid is summarized as follows:

For the year ended

February 28,

2009 March 1,

2008 March 3,

2007

Interest paid during the year $ 502 $ 518 $ 494

Income taxes paid during the year $ 946,237 $ 216,095 $ 32,101

(c) The following items are included in the accrued liabilities

balance:

As at

February 28,

2009 March 1,

2008

Marketing costs $ 91,160 $ 74,034

Warranty (note 13) 184,335 84,548

Royalties 279,476 150,151

Revenue rebates 134,788 60,282

Other 548,843 321,427

$ 1,238,602 $ 690,442

Other accrued liabilities as noted in the above chart, include,

among other things, salaries, payroll withholding taxes and

incentive accruals, none of which are greater than 5% of the

current liability balance.

(d) Additional information

Advertising expense, which includes media, agency and

promotional expenses totalling $337.3 million (March 1, 2008 -

$124.6 million; March 3, 2007 - $67.7 million) is included in

Selling, marketing and administration expense.