Blackberry 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

full because Dennis Kavelman and Angelo Loberto already

voluntarily paid those amounts to the Company at the same

time and on the same basis as Jim Balsillie and Mike Lazaridis.

In addition, Dennis Kavelman and Angelo Loberto each agreed

to be prohibited, for a period of five years from acting as an

officer or director of a company that is registered or required

to file reports with the SEC, and to be barred from appearing

or practicing as an accountant before the SEC with a right to

reapply after five years.

Messrs. Balsillie, Lazaridis, Kavelman and Loberto also

agreed to the payment of monetary penalties totaling, in

aggregate, $1.4 million to the SEC as an administrative penalty.

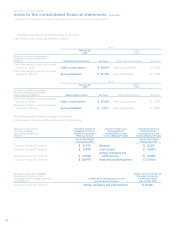

13. PRODUCT WARRANTY

The Company estimates its warranty costs at the time of

revenue recognition based on historical warranty claims

experience and records the expense in Cost of sales. The

warranty accrual balance is reviewed quarterly to establish

that it materially reflects the remaining obligation based on

the anticipated future expenditures over the balance of the

obligation period. Adjustments are made when the actual

warranty claim experience differs from estimates.

The change in the Company’s accrued warranty

obligations March 4, 2006 to February 28, 2009 as well as the

accrued warranty obligations as at February 28, 2009 are set

forth in the following table:

Accrued warranty obligations at March 4, 2006 $ 22,387

Actual warranty experience during fiscal 2007 (38,554)

Fiscal 2007 warranty provision 49,736

Adjustments for changes in estimate 3,100

Accrued warranty obligations at March 3, 2007 36,669

Actual warranty experience during fiscal 2008 (68,166)

Fiscal 2008 warranty provision 116,045

Accrued warranty obligations at March 1, 2008 84,548

Actual warranty experience during fiscal 2009 (146,434)

Fiscal 2009 warranty provision 258,757

Adjustments for changes in estimate (12,536)

Accrued warranty obligations at February 28, 2009 $ 184,335

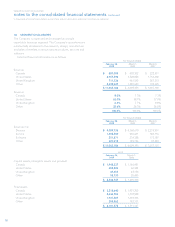

14. EARNINGS PER SHARE

The following table sets forth the computation of basic and

diluted earnings per share.

For the year ended

February 28,

2009 March 1,

2008 March 3,

2007

Net income for basic and diluted earnings per

share available to common shareholders $ 1,892,616 $ 1,293,867 $ 631,572

Weighted-average number of shares outstanding (000's) - basic 565,059 559,778 556,059

Effect of dilutive securities (000's): Stock-based compensation 9,097 13,052 15,750

Weighted-average number of shares and assumed conversions (000's) - diluted 574,156 572,830 571,809

Earnings per share - reported

Basic $ 3.35 $ 2.31 $ $1.14

Diluted $ 3.30 $ 2.26 $ $1.10