Blackberry 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

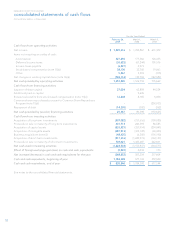

49

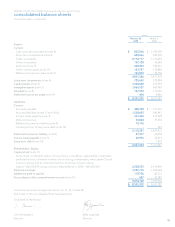

As at

February 28,

2009 March 1,

2008

Assets

Current

Cash and cash equivalents (note 4) $ 835,546 $ 1,184,398

Short-term investments (note 4) 682,666 420,709

Trade receivables 2,112,117 1,174,692

Other receivables 157,728 74,689

Inventory (note 5) 682,400 396,267

Other current assets (note 17) 187,257 135,849

Deferred income tax asset (note 9) 183,872 90,750

4,841,586 3,477,354

Long-term investments (note 4) 720,635 738,889

Capital assets (note 6) 1,334,648 705,955

Intangible assets (note 7) 1,066,527 469,988

Goodwill (note 8) 137,572 114,455

Deferred income tax asset (note 9) 404 4,546

$ 8,101,372 $ 5,511,187

Liabilities

Current

Accounts payable $ 448,339 $ 271,076

Accrued liabilities (notes 13 and 16(c)) 1,238,602 690,442

Income taxes payable (note 9) 361,460 475,328

Deferred revenue 53,834 37,236

Deferred income tax liability (note 9) 13,116 -

Current portion of long-term debt (note 10) -349

2,115,351 1,474,431

Deferred income tax liability (note 9) 87,917 65,058

Income taxes payable (note 9) 23,976 30,873

Long-term debt (note 10) -7,259

2,227,244 1,577,621

Shareholders’ Equity

Capital stock (note 11)

Authorized - unlimited number of non-voting, cumulative, redeemable, retractable

preferred shares; unlimited number of non-voting, redeemable, retractable Class A

common shares and an unlimited number of voting common shares

Issued - 566,218,819 voting common shares (March 1, 2008 - 562,652,461) 2,208,235 2,169,856

Retained earnings 3,545,710 1,653,094

Additional paid-in capital 119,726 80,333

Accumulated other comprehensive income (note 15) 457 30,283

5,874,128 3,933,566

$ 8,101,372 $ 5,511,187

Commitments and contingencies (notes 10, 12, 13, 17 and 19)

See notes to the consolidated financial statements.

On behalf of the Board:

John Richardson Mike Lazaridis

Director Director

RESEARCH IN MOTION LIMITED Incorporated under the Laws of Ontario

consolidated balance sheets

(United States dollars, in thousands)