Blackberry 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

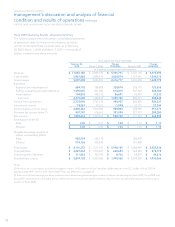

The following table sets forth certain consolidated statement

of operations data expressed as a percentage of revenue for

the periods indicated:

For the Fiscal Year Ended

February 28,

2009 March 1, 2008 Change

2009/2008 March 3, 2007 Change

2008/2007

Revenue 100.0% 100.0% -100.0% -

Cost of sales 53.9% 48.7% 5.2% 45.4% 3.3%

Gross margin 46.1% 51.3% (5.2%) 54.6% (3.3%)

Expenses

Research and development 6.2% 6.0% 0.2% 7.8% (1.8%)

Selling, marketing and administration 13.5% 14.7% (1.2%) 17.7% (3.0%)

Amortization 1.8% 1.8% -2.5% (0.7%)

21.5% 22.5% (1.0%) 28.0% (5.5%)

Income from operations 24.6% 28.8% (4.2%) 26.6% 2.2%

Investment income 0.7% 1.3% (0.6%) 1.7% (0.4%)

Income before income taxes 25.3% 30.1% (4.8%) 28.3% 1.8%

Provision for income taxes 8.2% 8.6% (0.4%) 7.5% 1.1%

Net income 17.1% 21.5% (4.4%) 20.8% 0.7%

Revenue for fiscal 2009 was $11.07 billion, an increase of $5.06

billion, or 84.1%, from $6.01 billion in fiscal 2008. The number

of BlackBerry devices sold increased by approximately 12.2

million, or 88.7%, to approximately 26.0 million in fiscal 2009,

compared to approximately 13.8 million in fiscal 2008. Device

revenue increased by $4.32 billion, or 90.6%, to $9.09 billion,

reflecting primarily the higher number of devices sold.

Service revenue increased by $541.9 million to $1.40 billion,

reflecting the increase of approximately 11 million net new

BlackBerry subscriber accounts since the end of fiscal 2008.

Software revenue increased by $17.5 million to $251.9 million

in fiscal 2009 and Other revenue increased by $175.3 million

to $321.0 million in fiscal 2009.

The Company’s net income for fiscal 2009 was $1.89

billion, an increase of $598.7 million, or 46.3%, compared

to net income of $1.29 billion in fiscal 2008. Basic earnings

per share (“basic EPS”) was $3.35 and diluted earnings per

share (“diluted EPS”) was $3.30 in fiscal 2009 compared to

$2.31 basic EPS and $2.26 diluted EPS in fiscal 2008, a 46.0%

increase when compared to fiscal 2008.

The $598.7 million increase in net income in fiscal 2009

primarily reflects an increase in gross margin in the amount of

$2.02 billion, resulting primarily from the increased number of

device shipments, which was partially offset by the decrease

of consolidated gross margin percentage and by an increase

of $1.33 billion in the Company’s investment in research and

development, selling, marketing and administration expenses

and provision for income taxes, which included the negative

impact of $99.7 million due to the significant depreciation of

the Canadian dollar relative to the U.S. dollar in the fiscal year.

See “Income Taxes”.

On February 11, 2009, the Company issued a press release

updating its forecast of its net new subscriber accounts and

reaffirming its financial guidance of its revenue, gross margin

and EPS for the fourth quarter of fiscal 2009. A copy of the

press release is available on SEDAR at www.sedar.com and on

the SEC’s website at www.sec.gov.

A more comprehensive analysis of these factors is

contained in “Results of Operations”.

Critical Accounting Policies and Estimates

General

The preparation of the Consolidated Financial Statements

requires management to make estimates and assumptions

with respect to the reported amounts of assets, liabilities,

revenues and expenses and the disclosure of contingent

assets and liabilities. These estimates and assumptions

are based upon management’s historical experience and

are believed by management to be reasonable under the

circumstances. Such estimates and assumptions are evaluated

on an ongoing basis and form the basis for making judgments

about the carrying values of assets and liabilities that are not

readily apparent from other sources. Actual results could

differ significantly from these estimates.