Blackberry 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

RIM’s network operations infrastructure as a result of the

increase in BlackBerry subscriber accounts. The Company

expects consolidated gross margins to be approximately

43-44% in the first quarter of fiscal 2010, based on the

Company’s current expectation for product mix, device ASP,

current product costs and foreign exchange. Based on the

Company’s current view and the potential for variation due

to these factors, the Company expects consolidated gross

margin percentage for fiscal year 2010 to be in the low forties.

Research and Development, Selling, Marketing and

Administration, and Amortization Expense

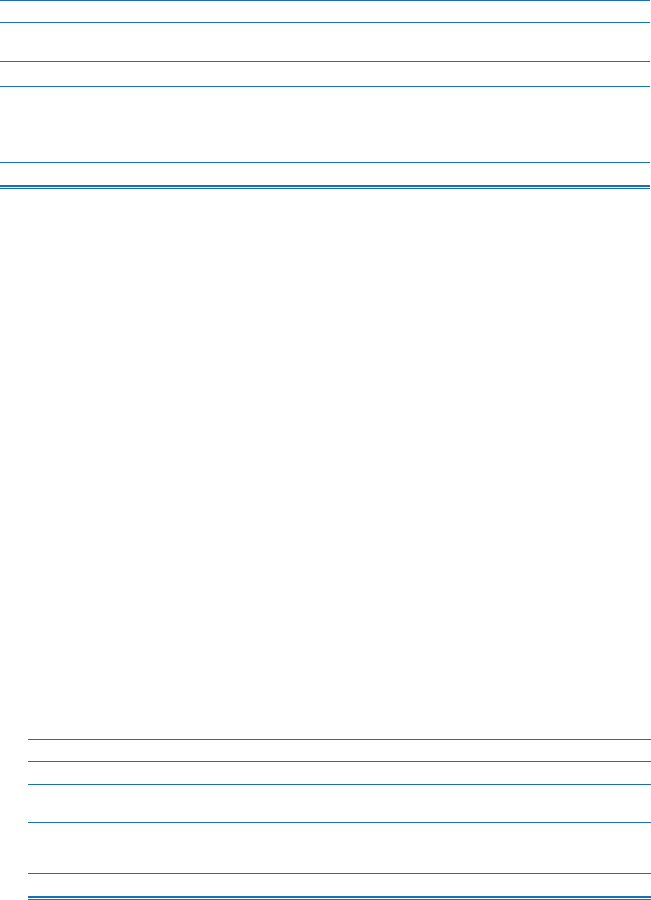

The table below presents a comparison of research and

development, selling, marketing and administration,

and amortization expenses for the quarter ended

February 28, 2009 compared to the quarter ended

November 29, 2008 and the quarter ended March 1, 2008.

The Company believes it is meaningful to provide a

comparison between the fourth quarter of fiscal 2009 and the

third quarter of fiscal 2009 given the quarterly increases in

revenue realized by the Company during fiscal 2009.

Three Month Fiscal Periods Ended

(in thousands)

February 28, 2009 November 29, 2008 March 1, 2008

% of

Revenue % of

Revenue % of

Revenue

Revenue $ 3,463,193 $ 2,782,098 $ 1,882,705

Research and development $ 182,535 5.3% $ 193,044 6.9% $ 104,573 5.6%

Selling, marketing and administration 406,493 11.7% 382,968 13.8% 267,881 14.2%

Amortization 61,595 1.8% 53,023 1.9% 31,314 1.7%

$ 650,623 18.8% $ 629,035 22.6% $ 403,768 21.4%

Total research and development, selling, marketing and

administration, and amortization expenses for the fourth

quarter as a percentage of revenue decreased by 3.8% to

18.8% of revenues when compared to the third quarter of

fiscal 2009.

Research and Development

Research and development expenditures increased by

$77.9 million to $182.5 million, or 5.3% of revenue, in the

fourth quarter of fiscal 2009, compared to $104.6 million,

or 5.6% of revenue, in the fourth quarter of fiscal 2008. The

majority of the increases during the fourth quarter of fiscal

2009 compared to the fourth quarter of fiscal 2008 were

attributable to salaries and benefits due to an increase

in the average headcount associated with research and

development activities, new product development costs and

office and related staffing infrastructure costs.

Selling, Marketing and Administration Expenses

Selling, marketing and administration expenses increased by

$138.6 million to $406.5 million for the fourth quarter of fiscal

2009 compared to $267.9 million for the comparable period in

fiscal 2008. As a percentage of revenue, selling, marketing and

administration expenses decreased to 11.7% in the fourth quarter

of fiscal 2009 compared to 14.2% in the fourth quarter of fiscal

2008. The net increase was primarily attributable to increased

expenditures for marketing, advertising and promotion expenses

including additional programs to support new product launches,

salary and benefits expenses primarily as a result of increased

personnel and office and related staffing infrastructure costs.

Amortization

The table below presents a comparison of amortization

expense relating to capital assets and intangible assets

for the quarter ended February 28, 2009 compared to the

quarter ended March 1, 2008.

(in thousands)

Included in Amortization Included in Cost of sales

Three Month Fiscal Period Ended

February 28,

2009 March 1,

2008 Change February 28,

2009 March 1,

2008 Change

Capital assets $ 36,662 $ 24,662 $ 12,000 $ 28,347 $ 12,824 $ 15,523

Intangible assets 24,933 6,652 18,281 26,183 6,374 19,809

Total $ 61,595 $ 31,314 $ 30,281 $ 54,530 $ 19,198 $ 35,332