Blackberry 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

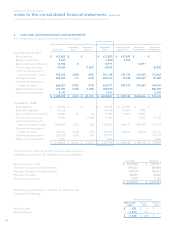

As at February 28, 2009, the total unrecognized income tax

benefits of $137.4 million includes approximately $104.5 million

of unrecognized income tax benefits that have been netted

against related deferred income tax assets. The remaining

$32.9 million is recorded within current taxes payable and other

non-current taxes payable on the Company’s consolidated

balance sheet as of February 28, 2009.

The Company’s total unrecognized income tax benefits

that, if recognized, would affect the Company’s effective

tax rate were $175.4 million and $137.4 as March 2, 2008 and

February 28, 2009, respectively.

A summary of open tax years by major jurisdiction is

presented below:

Jurisdiction

Canada (1) Fiscal 2001 - 2009

United States (1) Fiscal 2003 - 2009

United Kingdom Fiscal 2004 - 2009

(1) Includes federal as well as provincial and state jurisdictions, as

applicable.

The Company is subject to ongoing examination by tax

authorities in the jurisdictions in which it operates. The

Company regularly assesses the status of these examinations

and the potential for adverse outcomes to determine the

adequacy of the provision for income taxes. Specifically,

the Canada Revenue Agency (“CRA”) recently concluded

examining Scientific Research and Experimental Investment

Tax Credit elements of the Company’s fiscal 2001 to fiscal

2005 Canadian corporate tax filings. At this time, the

Company cannot reasonably anticipate when the CRA will

complete the remaining elements of its’ fiscal 2001 to fiscal

2005 examination. The CRA has also given the Company

notice that it will begin examining the Company’s fiscal 2006,

fiscal 2007 and fiscal 2008 Canadian corporate tax filings in

the 2009 calendar year.

The Company has other non-Canadian income tax

audits pending. While the final resolution of these audits

is uncertain, the Company believes the ultimate resolution

of these audits will not have a material adverse effect on

its consolidated financial position, liquidity or results of

operations. The Company believes it is reasonably possible

that approximately $8.5 million of its gross unrecognized

income tax benefit will decrease during fiscal 2010.

The Company recognizes interest and penalties related

to unrecognized income tax benefits as interest expense

that is netted and reported within Investment income. The

amount of interest and penalties accrued as at March 2, 2008

and February 28, 2009 is approximately $4.4 million and $5.4

million, respectively.

On March 12, 2009, the Government of Canada enacted

changes to the Income Tax Act (Canada) that allows RIM to

calculate its fiscal 2009 Canadian income tax expense based

on the U.S. dollar (the Company’s functional currency). As

such, the Company will record net benefits of approximately

$70 - $100 million relating to the enactment of the changes to

the Income Tax Act (Canada) in the first quarter of fiscal 2010.

10. LONG-TERM DEBT

The Company repaid its outstanding mortgage balance on

February 27, 2009. Interest expense on long-term debt for the

year was $502 (March 1, 2008 - $518; March 3, 2007 - $494).

The Company has a $100.0 million Demand Credit Facility

(the “Facility”) to support and secure operating and financing

requirements. As at February 28, 2009, the Company has

utilized $6.5 million of the Facility for outstanding letters

of credit and $93.5 million of the Facility is unused. The

Company has pledged specific investments as security for

this Facility.

The Company has an additional $2.0 million Demand

Credit Facility (the “Additional Facility”). The Additional

Facility is used to support and secure other operating

and financing requirements. As at February 28, 2009, the

Company has utilized $1.1 million of the Additional Facility for

outstanding letters of credit and $915 of this facility is unused.

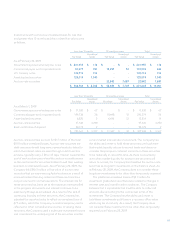

11. CAPITAL STOCK

(a) Share capital

The Company is authorized to issue an unlimited number

of non-voting, redeemable, retractable Class A common

shares, an unlimited number of voting common shares and

an unlimited number of non-voting, cumulative, redeemable,

retractable preferred shares. There are no Class A common

shares or preferred shares outstanding.

The Company declared a 3-for-1 stock split of the

Company’s outstanding common shares on June 28,

2007. The stock split was implemented by way of a stock

dividend. Shareholders received an additional two common

shares of the Company for each common share held. The

stock dividend was paid on August 20, 2007 to common

shareholders of record at the close of business on August 17,

2007. All share, earnings per share and stock option data have

been adjusted to reflect this stock dividend.