Blackberry 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED FEBRUARY 28, 2009

28

Review Costs

Included in the Company’s selling, marketing and

administration expenses in fiscal 2008 and fiscal 2009 are

legal, accounting and other professional costs incurred by

the Company as well as other costs incurred by the Company

under indemnity agreements in favor of certain officers and

directors of the Company, in each case in connection with the

Review, the Restatement, and the regulatory investigations

and litigation related thereto.

As noted above, Jim Balsillie and Mike Lazaridis, the

Company’s Co-Chief Executive Officers, voluntarily offered to

assist the Company in defraying costs incurred in connection

with the Review and the Restatement by contributing CAD

$10.0 million (CAD $5.0 million each) of those costs. The

Company received these voluntary payments in the second

quarter of fiscal 2008, which were recorded net of income

taxes as an increase to additional paid-in capital. In addition,

as part of the Notice of Application that was filed with the

Ontario Superior Court of Justice-Commercial List by a

pension fund shareholder, seeking various orders against the

Company and named directors, the Company and the other

defendants entered into an agreement with the shareholder

to settle the Application and a proposed derivative action.

Under the settlement, among other things, the Company

agreed to the payment of CAD $1.1 million on account of the

shareholder’s legal costs, and consistent with their earlier

voluntary agreement to contribute CAD $5.0 million each

to defray the costs incurred by RIM in connection with the

Review, Jim Balsillie and Mike Lazaridis, agreed to pay RIM

a further CAD $2.5 million each to defray the Review costs

incurred by the Company. The Company received these

voluntary payments of CAD $2.5 million each in the third

quarter of fiscal 2008, which were recorded net of income

taxes as an increase to additional paid-in capital. Under the

OSC settlement, Jim Balsillie, Mike Lazaridis and Dennis

Kavelman agreed to contribute an additional CAD $29.8

million (a total of CAD $44.8 million) to defray costs incurred

by the Company in the investigation and remediation of stock

options, granting practices and related governance practices

at the Company. These contributions are being made through

Jim Balsillie, Mike Lazaridis and Dennis Kavelman undertaking

not to exercise vested RIM options to acquire an aggregate

of 1,160,129 common shares of the Company. These options

have a fair value equal to the aggregate contribution amounts

determined using a BSM calculation based on the last trading

day prior to the day the OSC issued a notice of hearing in

respect of the matters giving rise to the settlement.

Risks Related to the Company’s Historical Stock Option

Granting Practices

As a result of the events described above, the Company

continues to be subject to risks which are discussed in

greater detail in the “Risk Factors” section of RIM’s Annual

Information Form, which is included in RIM’s Annual Report

on Form 40-F.

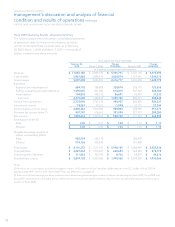

Results of Operations – Fiscal 2009 Compared to

Fiscal 2008 and Fiscal 2007

Fiscal year end February 28, 2009 compared to fiscal year

ended March 1, 2008

Revenue

Revenue for fiscal 2009 was $11.07 billion, an increase of $5.06

billion, or 84.1%, from $6.01 billion in fiscal 2008.

A comparative breakdown of the significant revenue streams

is set forth in the following table:

Fiscal 2009 Fiscal 2008 Change - Fiscal

2009/2008

Number of devices sold 26,009,000 13,780,000 12,229,000 88.7%

Average Selling Price (“ASP”) $ 349 $ 346 $ 3 0.9%

Revenues (in thousands)

Devices $ 9,089,736 82.1% $ 4,768,610 79.4% $ 4,321,126 90.6%

Service 1,402,560 12.7% 860,641 14.3% 541,919 63.0%

Software 251,871 2.3% 234,388 3.9% 17,483 7.5%

Other 321,019 2.9% 145,756 2.4% 175,263 120.2%

$ 11,065,186 100.0% $ 6,009,395 100.0% $ 5,055,791 84.1%