Blackberry 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

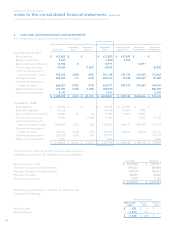

(d) Use of estimates

The preparation of the Company’s consolidated financial

statements in accordance with U.S. GAAP requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure

of contingent liabilities as at the dates of the consolidated

financial statements and the reported amounts of revenues

and expenses during the reporting periods. Significant

areas requiring the use of management estimates relate to

the determination of reserves for various litigation claims,

allowance for doubtful accounts, provision for excess and

obsolete inventory, fair values of assets acquired and liabilities

assumed in business combinations, royalties, amortization

expense, implied fair value of goodwill, provision for income

taxes, realization of deferred income tax assets and the

related components of the valuation allowance, provision for

warranty and the fair values of financial instruments. Actual

results could differ from these estimates.

(e) Foreign currency translation

The U.S. dollar is the functional and reporting currency of

the Company. Foreign currency denominated assets and

liabilities of the Company and all of its subsidiaries are

translated into U.S. dollars using the remeasurement method.

Accordingly, monetary assets and liabilities are translated

using the exchange rates in effect at the consolidated

balance sheet date and revenues and expenses at the rates

of exchange prevailing when the transactions occurred.

Resulting exchange gains and losses are included in income.

Non-monetary assets and liabilities are translated at historical

exchange rates.

(f) Cash and cash equivalents

Cash and cash equivalents consist of balances with banks and

liquid investments with maturities of three months or less at

the date of acquisition and are carried on the consolidated

balance sheets at fair value.

(g) Trade receivables

Trade receivables which reflect invoiced and accrued

revenue are presented net of an allowance for doubtful

accounts. The allowance was $2.1 million at February 28,

2009 (March 1, 2008 - $2.0 million). Bad debt expense

(recovery) was $24 for the year ended February 28, 2009

(March 1, 2008 – ($26); March 3, 2007 - $274).

The allowance for doubtful accounts reflects estimates

of probable losses in trade receivables. The Company is

dependent on a number of significant customers and on large

complex contracts with respect to sales of the majority of its

NATURE OF BUSINESS

Research In Motion Limited (“RIM” or the “Company”) is a

leading designer, manufacturer and marketer of innovative

wireless solutions for the worldwide mobile communications

market. Through the development of integrated hardware,

software and services that support multiple wireless network

standards, RIM provides platforms and solutions for seamless

access to time-sensitive information including email, phone,

short messaging service (SMS), Internet and intranet-based

applications. RIM technology also enables a broad array

of third party developers and manufacturers to enhance

their products and services with wireless connectivity to

data. RIM’s portfolio of award-winning products, services

and embedded technologies are used by thousands of

organizations around the world and include the BlackBerry

wireless solution, and other software and hardware. The

Company’s sales and marketing efforts include collaboration

with strategic partners and distribution channels to promote

the sale of its products and services as well as its own

supporting sales and marketing teams. The Company was

incorporated on March 7, 1984 under the Ontario Business

Corporations Act. The Company’s shares are traded on the

Toronto Stock Exchange under the symbol “RIM” and on the

NASDAQ Global Select Market under the symbol “RIMM”.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) General

These consolidated financial statements have been prepared

by management in accordance with United States generally

accepted accounting principles (“U.S. GAAP”) on a basis

consistent for all periods presented except as described

in note 2. Certain of the comparative figures have been

reclassified to conform to the current year presentation.

The significant accounting policies used in these U.S.

GAAP consolidated financial statements are as follows:

(b) Fiscal year

The Company’s fiscal year end date is the 52 or 53 weeks

ending on the last Saturday of February, or the first Saturday

of March. The fiscal years ended February 28, 2009, March 1,

2008 and March 3, 2007 comprise 52 weeks.

(c) Basis of consolidation

The consolidated financial statements include the accounts

of all subsidiaries with intercompany transactions and

balances eliminated on consolidation. All of the Company’s

subsidiaries are wholly-owned.

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements

In thousands of United States dollars, except share and per share data, and except as otherwise indicated