Blackberry 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

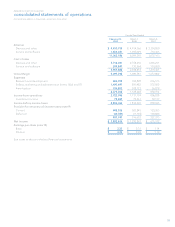

Fiscal year ended February 28, 2009 compared to the fiscal

year ended March 1, 2008

Operating Activities

Cash flow provided by operating activities was $1.45 billion

in fiscal 2009 compared to cash flow provided by operating

activities of $1.58 billion in the preceding fiscal year,

representing a decrease of $124.9 million. The table below

summarizes the key components of this net decrease.

Fiscal Year Ended

(in thousands)

February 28, 2009 March 1, 2008 Change - Fiscal

2009/2008

Net income $ 1,892,616 $ 1,293,867 $ 598,749

Amortization 327,896 177,366 150,530

Deferred income taxes (36,623)(67,244) 30,621

Income taxes payable (6,897)4,973 (11,870)

Stock-based compensation 38,100 33,700 4,400

Other 5,867 3,303 2,564

Net changes in working capital (769,114)130,794 (899,908)

Cash provided from operating activities $ 1,451,845 $ 1,576,759 $ (124,914)

The increase in working capital in fiscal 2009 was primarily

due to increases in trade receivables and inventory, partially

offset by an increase in accrued liabilities. The decrease in

working capital in fiscal 2008 was primarily due to increases in

income taxes payable and accrued liabilities, partially offset

by increases in trade receivables and inventory.

Financing Activities

Cash flow provided by financing activities was $25.4 million

for fiscal 2009 and was primarily provided by the proceeds

from the exercise of stock options and tax benefits from the

exercise of stock options, offset in part by repayment of the

long-term debt. The cash flow provided by financing activities

in fiscal 2008 in the amount of $80.4 million was primarily

attributable to proceeds from the exercise of stock options in

the amount of $62.9 million, as well as the voluntary payments

of CAD $7.5 million each made by the Company’s Co-Chief

Executive Officers. See “Restatement of Previously Issued

Financial Statements – Review Costs”.

Investing Activities

During the fiscal year ended February 28, 2009, cash flow

used in investing activities was $1.82 billion and included

capital asset additions of $833.5 million, intangible asset

additions of $687.9 million, business acquisitions of $48.4

million as well as transactions involving the proceeds on

sale or maturity of short-term investments and long-term

investments, net of the costs of acquisitions in the amount

of $253.7 million. For the same period of the prior fiscal year,

cash flow used in investing activities was $1.15 billion and

included capital asset additions of $351.9 million, intangible

asset additions of $374.1 million, as well as transactions

involving the proceeds on sale or maturity of short-term

investments and long-term investments, net of the costs

of acquisition, amounting to $421.7 million. The increase

in capital asset spending was primarily due to increased

investment in land and building purchases, renovations

to existing facilities, expansion and enhancement of

the BlackBerry infrastructure and computer equipment

purchases. The increase in intangible asset spending was

primarily associated with agreements with third parties

totalling $353 million for the use of intellectual property,

software, messaging services and other BlackBerry-related

features and several agreements to acquire portfolios of

patents relating to wireless communication technologies

totalling $279 million. All acquired patents were recorded

as Intangible assets and are being amortized over their

estimated useful lives.