Blackberry 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

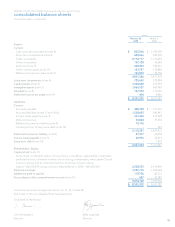

Fiscal Year 2009 Fiscal Year 2008

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

(in thousands, except per share data)

Revenue $ 3,463,193 $ 2,782,098 $ 2,577,330 $ 2,242,565 $ 1,882,705 $ 1,672,529 $ 1,372,250 $ 1,081,911

Gross margin $ 1,383,578 $ 1,269,506 $ 1,306,857 $ 1,137,357 $ 968,222 $ 847,872 $ 704,417 $ 560,070

Research and development,

Selling, marketing and

administration, and Amortization 650,623 629,035 604,624 490,920 403,768 357,978 311,464 276,212

Investment income (10,568) (31,554) (17,168) (18,977) (20,114) (23,816) (18,984) (16,447)

Income before income taxes 743,523 672,025 719,401 665,414 584,568 513,710 411,937 300,305

Provision for income taxes (1) 225,264 275,729 223,855 182,899 172,067 143,249 124,252 77,085

Net income $ 518,259 $ 396,296 $ 495,546 $ 482,515 $ 412,501 $ 370,461 $ 287,685 $ 223,220

Earnings per share (2)

Basic $ 0.92 $ 0.70 $ 0.88 $ 0.86 $ 0.73 $ 0.66 $ 0.51 $ 0.40

Diluted $ 0.90 $ 0.69 $ 0.86 $ 0.84 $ 0.72 $ 0.65 $ 0.50 $ 0.39

Research and development $ 182,535 $ 193,044 $ 181,347 $ 127,776 $ 104,573 $ 92,150 $ 88,171 $ 74,934

Selling, marketing

and administration 406,493 382,968 379,644 326,592 267,881 238,175 197,943 177,483

Amortization 61,595 53,023 43,633 36,552 31,314 27,653 25,350 23,795

$ 650,623 $ 629,035 $ 604,624 $ 490,920 $ 403,768 $ 357,978 $ 311,464 $ 276,212

Notes:

(1) Provision for income taxes includes the positive impact of fluctuations of the Canadian dollar relative to the U.S. dollar in the fourth quarter

of fiscal 2009 of approximately $3.5 million and the negative impact in the third quarter of fiscal 2009 of approximately $103.2 million. See

“Non-GAAP Financial Measures” below.

(2) Basic and diluted earnings per share for fiscal year 2009 and fiscal 2008, as presented in the table above, reflect the 3-for-1 stock split

implemented by way of a stock dividend that was paid in the second quarter of fiscal 2008.

Non-GAAP Financial Measures

The Company’s financial statements are prepared in

accordance with U.S. GAAP on a basis consistent for

all periods presented. In this MD&A, the Company has

presented the following “non-GAAP financial measures”:

adjusted net income, adjusted basic earnings per share and

adjusted diluted earnings per share. The term “non-GAAP

financial measure” is used to refer to a numerical measure

of a company’s historical or future financial performance,

financial position or cash flows that: (i) excludes amounts, or

is subject to adjustments that have the effect of excluding

amounts, that are included in the most directly comparable

measure calculated and presented in accordance with U.S.

GAAP in a company’s statement of income, balance sheet or

statement of cash flows; or (ii) includes amounts, or is subject

to adjustments that have the effect of including amounts, that

are excluded from the most directly comparable measure

so calculated and presented. Adjusted net income, adjusted

basic earnings per share and adjusted diluted earnings per

share are non-GAAP financial measures that exclude the

impact of exchange rate fluctuations between the Canadian

dollar and the U.S. dollar on the Company’s tax rate. This

section of the MD&A describes the Company’s use of such

non-GAAP financial measures.

The Company reported an income tax provision for

fiscal 2009 that was higher than previously forecasted, the

incremental portion of which will be reversed in the first quarter

of fiscal 2010. This annual provision reflects an effective tax

rate that is significantly higher than the Company’s historical

effective tax rate due to the significant depreciation of the

Canadian dollar relative to the U.S. dollar and its effect on

the Company’s U.S. dollar denominated assets and liabilities

held by RIM’s Canadian operating companies that are subject

to tax in Canadian dollars. The majority of this effect was

experienced in the third quarter of fiscal 2009. As described

in greater detail under “Income Taxes”, on March 12, 2009

changes to the Income Tax Act (Canada) that allow RIM to

calculate its fiscal 2009 Canadian income tax expense based

on the U.S. dollar (the Company’s functional currency) were

enacted. See “Income Taxes”. Although the Company elected