Blackberry 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

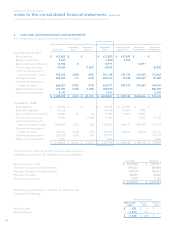

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

(v) Advertising costs

The Company expenses all advertising costs as incurred.

These costs are included in Selling, marketing and

administration.

2. ADOPTION OF ACCOUNTING POLICIES

The Fair Value Option for Financial Assets and Financial

Liabilities - Including an amendment of SFAS 115

In February 2007, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) 159 The Fair Value Option for Financial Assets and

Financial Liabilities - Including an amendment of SFAS 115

(“SFAS 159”). SFAS 159 permits entities to measure many

financial instruments and certain other items at fair value

that currently are not required to be measured at fair value.

If elected, unrealized gains or losses on certain items will be

reported in earnings at each subsequent reporting period.

SFAS 159 is effective for the Company as of the beginning of

its 2009 fiscal year. The Company did not adopt the fair value

measurement provisions of this statement.

Fair Value Measurements

In September 2006, the FASB issued SFAS 157 Fair Value

Measurements (“SFAS 157”). SFAS 157 clarifies the definition

of fair value, establishes a framework for measurement

of fair value, and expands disclosure about fair value

measurements. SFAS 157 is effective for fiscal years

beginning after November 15, 2007, except as amended by

FASB Staff Position (“FSP”) SFAS 157-1 and FSP SFAS 157-2

which is effective for fiscal years beginning after November

15, 2008. FSP SFAS 157-1 and FSP SFAS 157-2 allow partial

adoption relating to fair value measurements for non-financial

assets and liabilities that are not measured at fair value on

a recurring basis. Effective March 2, 2008, the Company

adopted SFAS 157, except as it applies to the nonfinancial

assets and nonfinancial liabilities subject to FSP SFAS 157-2,

with the impact described in note 4. The Company will adopt

the remaining portion of SFAS 157 in the first quarter of fiscal

2010 and does not expect the adoption to have a material

impact on the Company’s results of operations and financial

condition.

Disclosures about Derivative Instruments and Hedging

Activities – an amendment of FASB Statement No. 133

In March 2008, the FASB issued SFAS 161 Disclosures

about Derivative Instruments and Hedging Activities – an

amendment of FASB Statement No. 133 (“SFAS 161”). SFAS

161 enhances the current disclosure framework in SFAS 133

established by the Company. The Company has classified the

RSUs as equity instruments as the Company has the ability

and intent on settling the awards in shares. The compensation

expense is calculated based on the fair value of the award as

defined in SFAS 123(R) and the amount is recognized over the

vesting period of the RSU.

The Company has a Deferred Share Unit Plan (the “DSU

Plan”) adopted by the Board of Directors on December 20,

2007, under which each independent director will be credited

with Deferred Share Units (“DSUs”) in satisfaction of all or

a portion of the cash fees otherwise payable to them for

serving as a director of the Company. Grants under the DSU

plan replace the stock option awards that were historically

granted to independent members of the Board of Directors.

At a minimum, 50% of each independent director’s annual

retainer will be satisfied in the form of DSUs. The director

can elect to receive the remaining 50% in any combination of

cash and DSUs. Within a specified period after such a director

ceases to be a director, DSUs will be redeemed for cash with

the redemption value of each DSU equal to the weighted

average trading price of the Company’s shares over the five

trading days preceding the redemption date. Alternatively,

subject to receipt of shareholder approval, the Company may

elect to redeem DSUs by way of shares purchased on the

open market or issued by the Company.

DSUs are accounted for as liability-classified awards under

the provisions of SFAS 123(R). These awards are measured at

their fair value on the date of issuance, and remeasured at

each reporting period, until settlement. DSUs are awarded on

a quarterly basis.

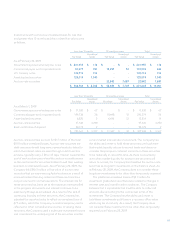

(u) Warranty

The Company provides for the estimated costs of product

warranties at the time revenue is recognized. BlackBerry

devices are generally covered by a time-limited warranty for

varying periods of time. The Company’s warranty obligation

is affected by product failure rates, differences in warranty

periods, regulatory developments with respect to warranty

obligations in the countries in which the Company carries

on business, freight expense, and material usage and other

related repair costs.

The Company’s estimates of costs are based upon

historical experience and expectations of future return rates

and unit warranty repair cost. If the Company experiences

increased or decreased warranty activity, or increased or

decreased costs associated with servicing those obligations,

revisions to the estimated warranty liability would be

recognized in the reporting period when such revisions

are made.