Blackberry 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

and Kavelman undertaking not to exercise certain vested RIM

options to acquire an aggregate of 1,160,129 common shares

of RIM. These options have a fair value equal to the aggregate

contribution amounts determined using a BSM calculation

based on the last trading day prior to the day the OSC issued

a notice of hearing in respect of the matters giving rise to the

settlement. These options are shown as outstanding, vested

and exercisable as at February 28, 2009 in the table below.

Messrs. Balsillie, Lazaridis, Kavelman and Loberto have also

paid a total of CAD $9.1 million to the OSC as an administrative

penalty and towards the costs of the OSC’s investigation.

In June 2007, the Board amended the Stock Option Plan

to provide that options held by directors of the Company will

not terminate upon a director ceasing to be a director of the

Company if such person is appointed as a Director Emeritus

of the Board. This resulted in a modification for accounting

purposes of unvested options previously granted to two

directors who where appointed Directors Emeritus during

the second quarter of fiscal 2008, which in turn required the

Company to record additional compensation expense in fiscal

2008 in the amount of $3.5 million.

A summary of option activity since March 4, 2006 is shown

below.

As previously disclosed, the Company’s Co-Chief

Executive Officers voluntarily offered to assist the Company

in defraying costs incurred in connection with the Review and

the Restatement by contributing CAD $10.0 million (CAD $5.0

million by each Co-CEO) of those costs. As part of a settlement

agreement reached with a pension fund, an additional CAD

$5.0 million (CAD $2.5 million by each Co-CEO) was received

in the third quarter of fiscal 2008. The Company received these

voluntary payments in the second and third quarters of fiscal

2008 and were recorded net of income taxes as an increase to

additional paid-in capital. Furthermore, as part of a settlement

agreement reached with the Ontario Securities Commission

(“OSC”) as more fully described in note 12(c), Messrs. Balsillie,

Lazaridis and Kavelman also agreed to contribute, in aggregate,

a total of approximately CAD $83.1 million to RIM, consisting

of (i) a total of CAD $38.3 million to RIM in respect of the

outstanding benefit arising from incorrectly priced stock options

granted to all RIM employees from 1996 to 2006, and (ii) a

total of CAD $44.8 million to RIM (CAD $15.0 million of which

had previously been paid) to defray costs incurred by RIM in

the investigation and remediation of stock options, granting

practices and related governance practices at RIM. These

contributions are being made through Messrs. Balsillie, Lazaridis

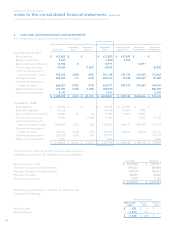

Options Outstanding

Number

(in 000’s)

Weighted-

Average

Exercise

Price

Average

Remaining

Contractual

Life in Years

Aggregate

Intrinsic

Value

Balance as at March 4, 2006 26,883 $ 6.78

Granted during the year 1,752 37.15

Exercised during the year (9,126) 4.30

Forfeited/cancelled/expired during the year (348) 9.97

Balance as at March 3, 2007 19,161 $ 10.85

Granted during the year 2,518 101.60

Exercised during the year (5,039) 10.82

Forfeited/cancelled/expired during the year (174) 31.76

Balance as at March 1, 2008 16,466 $ 28.66

Exercised during the year (3,565) 7.60

Forfeited/cancelled/expired during the year (170) 60.25

Balance as at February 28, 2009 12,731 $ 27.51 2.60 $ 262,250

Vested and expected to vest at February 28, 2009 12,484 $ 26.99 2.57 $ 260,746

Exercisable at February 28, 2009 8,686 $ 15.07 1.82 $ 255,238

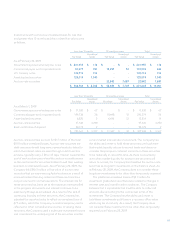

The aggregate intrinsic value in the table above represents the

total pre-tax intrinsic value (the aggregate difference between

the closing stock price of the Company’s common stock on

February 28, 2009 and the exercise price for in-the-money

options) that would have been received by the option

holders if all in-the-money options had been exercised on

February 28, 2009. The intrinsic value of stock options exercised

during fiscal 2009, calculated using the average market price

during the period, was approximately $82 per share.