Blackberry 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

2009. The Company believes its financial resources, together

with expected future earnings, are sufficient to meet funding

requirements for current financial commitments, for future

operating and capital expenditures not yet committed, and

also provide the necessary financial capacity to meet current

and future growth expectations.

The Company has a $100 million Demand Credit Facility

(the “Facility”) to support and secure operating and financing

requirements. As at February 28, 2009, the Company has

utilized $6.5 million of the Facility for outstanding Letters of

Credit and $93.5 million of the Facility is unused. The Company

has pledged specific investments as security for this Facility.

The Company has an additional $2.0 million Demand

Credit Facility (the “Additional Facility”). The Additional

Facility is used to support and secure other operating

and financing requirements. As at February 28, 2009, the

Company has utilized $1.1 million of the Additional Facility for

outstanding letters of credit and $0.9 million of the Additional

Facility is unused.

The Company does not have any off-balance sheet

arrangements as defined in Item 303(a)(4)(ii) of Regulation

S-K under the Exchange Act and under applicable Canadian

securities laws.

Market Risk of Financial Instruments

The Company is engaged in operating and financing

activities that generate risk in three primary areas:

Foreign Exchange

The Company is exposed to foreign exchange risk as a

result of transactions in currencies other than its functional

currency, the U.S. dollar. The majority of the Company’s

revenues in fiscal 2009 are transacted in U.S. dollars. Portions

of the revenues are denominated in British Pounds, Canadian

dollars and Euros. Purchases of raw materials are primarily

transacted in U.S. dollars. Other expenses, consisting of

the majority of salaries and income taxes, certain operating

costs and manufacturing overhead are incurred primarily

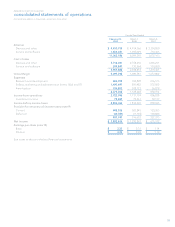

Aggregate Contractual Obligations

The following table sets out aggregate information about the

Company’s contractual obligations and the periods in which

payments are due as at February 28, 2009:

(in thousands)

Total Less than

One Year One to

Three Years Four to

Five Years Greater than

Five Years

Operating lease obligations $183,380 $ 25,244 $ 66,468 $ 36,547 $ 55,121

Purchase obligations and commitments 4,228,407 4,228,407 - - -

Total $4,411,787 $ 4,253,651 $ 66,468 $ 36,547 $ 55,121

Purchase obligations and commitments amounted to

approximately $4.23 billion as of February 28, 2009, with

purchase orders with contract manufacturers representing

approximately $3.48 billion of the total. The Company also

has commitments on account of capital expenditures of

approximately $128.4 million included in this total, primarily

for manufacturing, facilities and information technology,

including service operations. The remaining balance consists

of purchase orders or contracts with suppliers of raw

materials, as well as other goods and services utilized in the

operations of the Company. The expected timing of payment

of these purchase obligations and commitments is estimated

based upon current information. The timing of payments and

actual amounts paid may be different depending upon the

time of receipt of goods and services, changes to agreed-

upon amounts for some obligations or payment terms.

On February 10, 2009, the Company entered into an

agreement with Certicom Corp. (“Certicom”) to acquire all

of the issued and outstanding common shares of Certicom

by way of statutory plan of arrangement at a price of CAD

$3.00 for each common share of Certicom or approximately

CAD $131 million (approximately $102 million). The transaction

closed on March 23, 2009. The Certicom shares purchased

under the offer were funded with the Company’s cash on hand.

The Company has obligations payable in the first quarter

of fiscal 2010 of approximately $290 million for the payment

of income taxes related to fiscal 2009. The Company paid

approximately $475 million in the first quarter of fiscal

2009 in respect of income taxes related to fiscal 2008. The

amounts have been included as Current liabilities in Income

taxes payable as of February 28, 2009 and March 1, 2008

respectively, and the Company intends to fund its fiscal 2009

tax obligations from existing financial resources and cash

flows.

The Company has not paid any cash dividends in the last

three fiscal years.

Cash and cash equivalents, short-term investments and

long-term investments were $2.24 billion as at February 28,