Blackberry 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

to enhance the online experience for mobile, dial and

broadband subscribers, while significantly reducing

bandwidth requirements.

During fiscal 2007, the Company purchased 100% of the

common shares of Ascendent Systems Inc. (“Ascendent”).

The transaction closed on March 9, 2006. Ascendent

specializes in enterprise solutions to simplify voice mobility

implementations and allows the Company to further extend

and enhance the use of wireless communications by offering

a voice mobility solution that helps customers align their

mobile voice and data strategies.

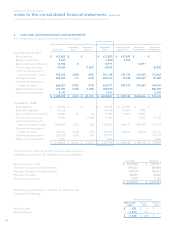

The following table summarizes the estimated fair value

of the assets acquired and liabilities assumed at the date of

acquisition along with prior year’s acquisition allocations:

During fiscal 2008, the Company purchased the assets and

intellectual property of a company. The transaction closed

on November 19, 2007. In addition, the Company purchased

100% of the common shares of a company whose proprietary

software will be incorporated into the Company’s software.

The transaction closed on August 22, 2007.

During fiscal 2007, the Company purchased 100% of the

common shares of a company whose proprietary software

will be incorporated into the Company’s software. The

transaction closed on September 22, 2006.

During fiscal 2007, the Company purchased 100% of

the common shares of Slipstream Data Inc. (“Slipstream”).

The transaction closed on July 7, 2006. Slipstream provides

acceleration, compression and network optimization

For the year ended

February 28,

2009 March 1,

2008 March 3,

2007

Assets purchased

Current assets $ 1,155 $ 23 $ 3,707

Capital assets 494 - 802

Deferred income tax asset 3,097 - 10,440

Acquired technology 31,226 1,035 40,266

In-process research and development 1,919 - -

Patents -960 -

Goodwill 23,117 4,523 80,906

61,008 6,541 136,121

Liabilities assumed 12,583 - 8,597

Deferred income tax liability -341 11,334

12,583 341 19,931

Net non-cash assets acquired 48,425 6,200 116,190

Cash acquired 1,421 1 3,649

Net assets acquired $ 49,846 $ 6,201 $ 119,839

Consideration

Cash $ 49,846 $ 6,201 $ 119,839

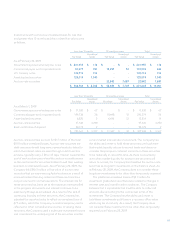

The acquisitions were accounted for using the purchase

method whereby identifiable assets acquired and liabilities

assumed were recorded at their estimated fair value as of the

date of acquisition. The excess of the purchase price over

such fair value was recorded as goodwill. In-process research

and development is charged to Amortization expense

immediately after acquisition.

The weighted average remaining amortization period of

the acquired technology related to the business acquisitions

completed in fiscal 2009 is 4.6 years (2008 – 4.6 years).

On February 10, 2009, the Company entered into an

agreement with Certicom Corp. (“Certicom”) by way of

statutory plan of arrangement to acquire all of the issued

and outstanding common shares at a price of CAD $3.00

for each common share of Certicom or approximately CAD

$131 million (approximately $102 million). The transaction

closed on March 23, 2009, subsequent to the Company’s fiscal

2009 year. Certicom technology protects the value of content,

applications and devices with government approved security

using Elliptic Curve Cryptography. The Company has not

provided a preliminary purchase price allocation due to lack

of access to the required information during the unsolicited

bid stage of the offer and the limited amount of time between

the closing date of the transaction and the filing date of these

consolidated financial statements.