Blackberry 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED FEBRUARY 28, 2009

18

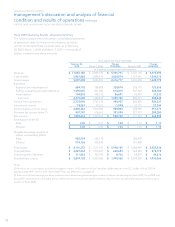

Fiscal 2009 Operating Results – Executive Summary

The following table sets forth certain consolidated statement

of operations data, for the periods indicated, as well as

certain consolidated balance sheet data, as at February

28, 2009, March 1, 2008 and March 3, 2007 in thousands of

dollars, except for per share amounts.

As at and for the Fiscal Year Ended

February 28,

2009 March 1, 2008 Change

2009/2008 March 3, 2007 Change

2008/2007

(in thousands, except for per share amounts)

Revenue $ 11,065,186 $ 6,009,395 $ 5,055,791 $ 3,037,103 $ 2,972,292

Cost of sales 5,967,888 2,928,814 3,039,074 1,379,301 1,549,513

Gross margin 5,097,298 3,080,581 2,016,717 1,657,802 1,422,779

Expenses

Research and development 684,702 359,828 324,874 236,173 123,655

Selling, marketing and administration 1,495,697 881,482 614,215 537,922 343,560

Amortization 194,803 108,112 86,691 76,879 31,233

Sub-total 2,375,202 1,349,422 1,025,780 850,974 498,448

Income from operations 2,722,096 1,731,159 990,937 806,828 924,331

Investment income 78,267 79,361 (1,094)52,117 27,244

Income before income taxes 2,800,363 1,810,520 989,843 858,945 951,575

Provision for income taxes (1) 907,747 516,653 391,094 227,373 289,280

Net income $ 1,892,616 $ 1,293,867 $ 598,749 $ 631,572 $ 662,295

Earnings per share (2)

Basic $ 3.35 $ 2.31 $ 1.04 $ 1.14 $ 1.17

Diluted $ 3.30 $ 2.26 $ 1.04 $ 1.10 $ 1.16

Weighted-average number of

shares outstanding (000’s)

Basic 565,059 559,778 556,059

Diluted 574,156 572,830 571,809

Total assets $ 8,101,372 $ 5,511,187 $ 2,590,185 $ 3,088,949 $ 2,422,238

Total liabilities $ 2,227,244 $ 1,577,621 $ 649,623 $ 605,449 $ 972,172

Total long-term liabilities $ 111,893 $ 103,190 $ 8,703 $ 58,874 $ 44,316

Shareholders’ equity $ 5,874,128 $ 3,933,566 $ 1,940,562 $ 2,483,500 $ 1,450,066

Notes:

(1) Provision for income taxes includes the negative impact of fluctuations of the Canadian dollar relative to the U.S. dollar in fiscal 2009 of

approximately $99.7 million. See “Non-GAAP Financial Measures” on page 39.

(2) Basic and diluted earnings per share and basic and diluted weighted-average number of shares outstanding for fiscal 2009, fiscal 2008 and

fiscal 2007, as presented in the table above, reflect the 3-for-1 stock split implemented by way of a stock dividend that was paid in the second

quarter of fiscal 2008.