Blackberry 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

the potential impact that a restructuring will have on the value

of these securities and has classified these securities as long-

term investments. The Company may recognize additional

impairment charges on these securities if the restructuring

is unsuccessful or there is an other-than-temporary

deterioration in the value of the underlying assets.

Fair Value Measurements

SFAS 157 defines fair value as the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the

measurement date. SFAS 157 establishes a three-tier value

hierarchy, which prioritizes the inputs used in the valuation

methodologies in measuring fair value:

• Level 1 — Unadjusted quoted prices at the measurement

date for identical assets or liabilities in active markets.

• Level 2 — Observable inputs other than quoted prices

included in Level 1, such as quoted prices for similar

assets and liabilities in active markets; quoted prices for

identical or similar assets and liabilities in markets that are

not active; or other inputs that are observable or can be

corroborated by observable market data.

• Level 3 — Significant unobservable inputs which are

supported by little or no market activity.

The fair value hierarchy also requires an entity to maximize

the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.

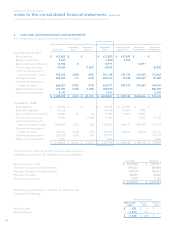

The following table presents the Company’s assets and

liabilities that are measured at fair value on a recurring basis:

A Structured Investment Vehicle (“SIV”) is a fund that

seeks to generate investment returns by purchasing high

grade long-term fixed income instruments and funding those

purchases by issuing short-term debt instruments. In late

2007, widespread illiquidity in the market has prevented SIVs

from accessing necessary funding for ongoing operations. In

determining the value for these securities, the Company has

considered available evidence including changes in general

market conditions, specific industry and individual company

data, the length of time and the extent to which the fair value

has been less than cost, the financial condition, the near-term

prospects of the individual investment and the Company’s

intent and ability to hold the debt securities.

The outstanding SIV holdings have been placed with

an enforcement manager to be restructured or sold at the

election of each senior note holder. The Company has

elected to participate in the restructuring of the securities.

The Company believes that the anticipated restructuring

will likely result in extended maturities and/or a pro-rata

distribution of proceeds from the income and principal

payments on the assets underlying the securities. As part of

this process, the Company received a total of $4.5 million in

principal and interest payments from the SIV. As at February

28, 2009, the Company held $22.5 million face value of SIV

securities that were negatively impacted by the changes

in market conditions and has not recorded an other-than-

temporary impairment charges in fiscal 2009 (in fiscal

2008, the Company recorded any other-than-temporary

impairment charge of $3.8 million). Given the uncertainty of

the restructuring at this time, the Company cannot determine

As at February 28, 2009 Level 1 Level 2 Level 3 Total

Assets

Available-for-sale investments $ 5,000 $ 1,699,251 $ 51,544 $ 1,755,795

Derivative instruments - 70,100 - 70,100

Total Assets $ 5,000 $ 1,769,351 $ 51,544 $ 1,825,895

Liabilities

Derivative instruments - 56,827 - 56,827

Total Liabilities $ - $ 56,827 $ - $ 56,827