Blackberry 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

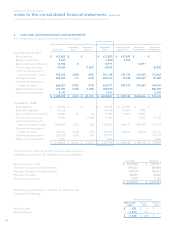

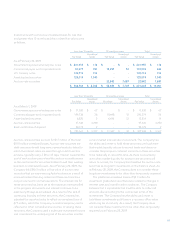

4. CASH AND CASH EQUIVALENTS AND INVESTMENTS

The components of cash and investments were as follows:

Cost Basis Unrealized

Gains Unrealized

Losses Recorded

Basis Cash and Cash

Equivalents Short-term

Investments Long-term

Investments

As at February 28, 2009

Bank balances $ 477,855 $ - $ - $ 477,855 $ 477,855 $ - $ -

Money market fund 5,000 - - 5,000 5,000 - -

Bank certificates of deposit 14,963 8 - 14,971 - 14,971 -

Auction-rate securities 40,529 - (7,687) 32,842 - 32,842

Commercial paper and

corporate notes / bonds 404,623 3,608 (443) 407,788 124,720 145,605 137,463

US treasury notes 245,050 717 (153) 245,614 19,398 205,633 20,583

Government sponsored

enterprise notes 666,627 2,922 (178) 669,371 208,573 316,457 144,341

Asset-backed securities 379,091 2,658 (1,540) 380,209 - - 380,209

Other cost investments 5,197 - - 5,197 - - 5,197

$ 2,238,935 $ 9,913 $ (10,001) $ 2,238,847 $ 835,546 $ 682,666 $ 720,635

As at March 1, 2008

Bank balances $ 125,904 $ - $ - $ 125,904 $ 125,904 $ - $ -

Bank term deposits 116,768 - - 116,768 114,909 1,859 -

Bank certificates of deposit 93,280 27 (2) 93,305 37,818 55,487 -

Auction-rate securities 55,067 - (3,230) 51,837 - 14,512 37,325

Commercial paper and

corporate notes / bonds 1,041,835 3,442 (54) 1,045,223 666,114 255,975 123,134

Government sponsored

enterprise notes 606,879 3,468 (67) 610,280 239,653 92,876 277,751

Asset-backed securities 291,689 3,504 (14) 295,179 - - 295,179

Other cost investments 5,500 - - 5,500 - - 5,500

$ 2,336,922 $ 10,441 $ (3,367) $ 2,343,996 $ 1,184,398 $ 420,709 $ 738,889

The contractual maturities of cash and cash equivalents and

investments at February 28, 2009 were recorded as follows:

Cost Basis Fair Value

Due in one year or less $ 1,516,825 $ 1,518,211

Due after one year through five years 550,447 556,084

Due after five years through ten years 125,937 126,513

Due after ten years 40,529 32,842

No fixed maturity date 5,197 5,197

$ 2,238,935 $ 2,238,847

Realized gains and losses on available-for-sale securities

comprise the following:

For the year ended

February 28,

2009 March 1,

2008 March 3,

2007

Realized gains $ 158 $ 10 $ -

Realized losses (1,801) (410) -

$ (1,643) $ (400) $ -