Blackberry 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Results and Administration

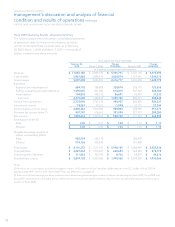

Revenue in fiscal 2009 grew to approximately $11 billion from

$6 billion in the previous year. Hardware continued to repre-

sent the largest percentage of revenue at 82%, with service

contributing approximately 13%, and software, accessories,

and other revenue contributing the remainder. RIM shipped

approximately 26 million smartphones in fiscal 2009, which

was driven by strong demand from new customers as well as

handset upgrades from a loyal customer base.

Gross margin for the year was approximately 46%, down

from fiscal 2008. This decline was principally related to the

introduction of new feature-rich, premium smartphones with

higher associated costs (such as the BlackBerry Bold smart-

phone, BlackBerry Storm smartphone and BlackBerry Curve

8900 smartphone), an increased percentage of revenue derived

from hardware sales relative to software and service fees, and

unfavorable trends in foreign exchange rates.

The past year has been a period of significant investment

for RIM with the launch of a new brand campaign, an aggres-

sive entry into broader market segments and the expansion of

our global R&D capabilities. We plan to leverage these types

of investments and take advantage of opportunities for cost

improvements to grow RIM’s market share and profitability in

fiscal 2010.

Operating expenses for the year totaled approximately

$2.38 billion and remained flat with the previous year as a

percentage of revenue as we continued to invest in brand,

channels and R&D.

Net income in fiscal 2009 increased to $1.89 billion or $3.30

per share fully diluted versus $1.29 billion or $2.26 per share

fully diluted in the prior year.

Capital expenditures increased from approximately $350

million in fiscal 2008 to approximately $834 million in fiscal

2009. The majority of this investment was for new facilities,

computers and equipment to support RIM’s growing employee

base and the expansion and enhancement of the BlackBerry®

Infrastructure. RIM also invested $736 million during the year

for acquisitions of intellectual property and companies with

strategic technologies that enhance RIM’s business.

RIM continues to have a strong balance sheet with no debt

and approximately $2.24 billion in cash, cash equivalents,

short-term investments and long-term investments.

RIM had over 12,000 employees at the end of fiscal 2009,

up from approximately 8,400 employees at the end of fiscal

2008. This increase was spread across all areas of the com-

pany including R&D, carrier support, business development,

marketing, customer care and manufacturing. We continue to

recruit the best talent and believe that RIM’s team of dedicated

employees is our strongest asset.

Sales, Marketing & Distribution

During the past year, RIM continued to expand the availability

of BlackBerry products and services through expansion of dis-

tribution channels in North America and around the world. We

made significant inroads with retail partners and saw the con-

tribution from these channels grow substantially over the year.

Retail sales during the holiday buying season this year were the

strongest ever for RIM, and independent surveys indicated that

BlackBerry smartphones consistently ranked in the top three

bestsellers in North America. BlackBerry smartphones are now

available through approximately 475 carriers and distribution

channels, in over 160 countries around the world.

R&D and Manufacturing

RIM’s product development philosophy has always been

defined by the underlying values of innovation, quality and effi-

ciency; and in fiscal 2009, the R&D team did an exceptional job

of delivering on these values. RIM undertook the ambitious

task of launching a record number of new BlackBerry smart-

phones that incorporated the latest chipset technologies, next

generation network support, new high resolution displays, new

and innovative input technologies and completely new user

interfaces. The launches of these new products – including the

BlackBerry Bold smartphone (RIM’s first HSDPA smartphone),

the BlackBerry Storm smartphone (RIM’s first touch-screen

smartphone with the award-winning SurePress™ technology),

the BlackBerry Pearl Flip smartphone (RIM’s first “clam-shell”

smartphone), the iDen-based BlackBerry Curve 8350i smart-

phone (with Push-to-Talk) and the BlackBerry Curve 8900

smartphone (based on a next generation platform) - were key

factors that contributed to the stellar revenue and market share

growth experienced by RIM this year.

10

RIM made significant inroads into third

party retail outlets and saw the contribution

from these channels grow substantially over

the past year.

“