Blackberry 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

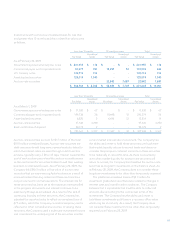

A summary of unvested stock options since March 1, 2008

is shown below:

Options Outstanding

Number

(in 000's)

Weighted

Average

Grant Date

Fair Value

Balance as at March 1, 2008 7,257 $ 22.89

Vested during the period (3,042) 13.20

Forfeited during the period (170) 34.45

Balance as at February 28, 2009 4,045 $ 29.69

As of February 28, 2009, there was $95.5 million of

unrecognized stock-based compensation expense related

to unvested stock options which will be expensed over the

vesting period, which, on a weighted-average basis, results

in a period of approximately 2.1 years. The total fair value of

stock options vested during the year ended February 28, 2009

was $40.1 million.

Cash received from stock option exercises for the year

ended February 28, 2009 was $27.0 million (March 1, 2008 -

$62.9 million). Tax benefits realized by the Company related to

the stock option exercises were $12.6 million (March 1, 2008 -

$8.2 million; March 3, 2007 - $6.0 million).

There were no stock options granted in fiscal 2009. The

weighted-average fair value of stock options granted during

the previous two years was calculated using the BSM option-

pricing model with the following assumptions:

For the year ended

March 1,

2008 March 3,

2007

Number of options granted (000's) 2,518 1,752

Weighted-average BSM value of each option $ 47.11 $ 16.63

Assumptions:

Risk-free interest rate 4.3% 4.8%

Expected life in years 4.6 4.4

Expected dividend yield 0% 0%

Volatility 41% - 57% 44% - 55%

The Company has not paid a dividend in the previous eleven

fiscal years and has no current expectation of paying cash

dividends on its common shares. The risk-free interest rates

utilized during the life of the stock options are based on a

U.S. Treasury security for an equivalent period. The Company

estimates the volatility of its common shares at the date of

grant based on a combination of the implied volatility of

publicly traded options on its common shares, and historical

volatility, as the Company believes that this is a better

indicator of expected volatility going forward. The expected

life of stock options granted under the plan is based on

historical exercise patterns, which the Company believes are

representative of future exercise patterns.

Restricted Share Unit Plan

RSUs are redeemed for either common shares issued the by

Company, common shares purchased on the open market

or the cash equivalent on the vesting dates established by

the Company. Compensation expense is recognized upon

issuance of RSUs over the vesting period. The Company

recorded $196 of compensation expense with respect to RSUs

in the year ended February 28, 2009 (March 1, 2008 - $33).

The Company did not issue any RSUs in the year ended

February 28, 2009 and there were 3,334 RSUs outstanding as

at February 28, 2009 (March 1, 2008 – 5,000).