Berkshire Hathaway 1998 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

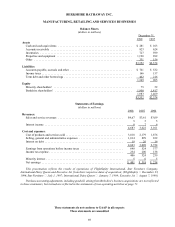

BERKSHIRE HATHAWAY INC.

NON-OPERATING ACTIVITIES

These statements reflect the consolidated financial statement values for assets, liabilities, shareholders' equity,

revenues and expenses that were not assigned to any Berkshire operating group in the unaudited, and not fully GAAP -

adjusted group financial statements heretofore presented (pages 65 to 70).

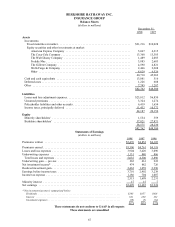

Statements of Net Assets

(dollars in millions)

December 31,

1998 1997

Assets

Cash and cash equivalents ................................................... $ 220 $ 383

Investments:

Fixed maturities ........................................................ 30 269

Equity securities ........................................................ 267 307

Unamortized goodwill and other purchase accounting adjustments * ................... 18,613 3,099

Deferred tax assets ........................................................ 130 136

Other .................................................................. 128 104

$19,388 $4,298

Liabilities

Accounts payable, accruals and other .......................................... $ 40 $ 40

Income taxes ............................................................. 158 152

Borrowings under investment agreements and other debt ........................... 1,863 2,016

2,061 2,208

Equity

Minority shareholders’ ..................................................... 15 45

Berkshire shareholders’ ..................................................... 17,312 2,045

17,327 2,090

$19,388 $4,298

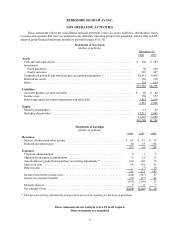

Statements of Earnings

(dollars in millions)

1998 1997 1996

Revenues:

Interest, dividend and other income ..................................... $ 63 $ 41 $ 55

Realized investment gain ............................................ 40 53 194

103 94 249

Expenses:

Corporate administration ............................................ 6 7 5

Shareholder-designated contributions ................................... 17 15 13

Amortization of goodwill and purchase accounting adjustments * .............. 210 105 76

Interest on debt .................................................... 96 101 91

Other income ..................................................... — (7) (3)

329 221 182

Income (loss) before income taxes ...................................... (226) (127) 67

Income tax expense (benefit) .......................................... (33) (17) 44

(193) (110) 23

Minority interest ................................................... 5 8 7

Net earnings (loss) ................................................. $(198)$(118)$ 16

* Purchase accounting adjustments and goodwill arose in accounting for business acquisitions.

These statements do not conform to GAAP in all respects

These statements are unaudited