Berkshire Hathaway 1998 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

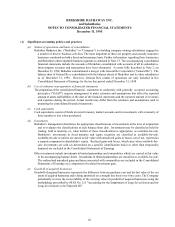

(2) Business acquisitions (Continued)

Under the terms of the merger agreement, General Re shareholders received at their election either 0.0035 shares of

Berkshire Class A Common Stock or 0.105 shares of Berkshire Class B Common Stock for each share of General Re

common stock they owned. Berkshire issued approximately 272,200 Class A equivalent shares in exchange for the General

Re shares outstanding as of December 21, 1998. The total consideration for the transaction, based upon the closing prices

of Berkshire Class A Common Stock for the 10-day period ending June 26, 1998, was approximately $22 billion.

General Re is a holding company for global reinsurance and related risk management operations. It owns General

Reinsurance Corporation and National Reinsurance Corporation, the largest professional property and casualty reinsurance

group domiciled in the United States. General Re also owns a controlling interest in Kölnische Rückversicherungs-

Gesellschaft AG (Cologne Re), a major international reinsurer. Together, General Re and Cologne Re transact reinsurance

business as “General & Cologne Re”.

In addition, General Re writes excess and surplus lines insurance through General Star Management Company,

provides alternative risk solutions through Genesis Underwriting Management Company, provides reinsurance brokerage

services through Herbert Clough, Inc., manages aviation insurance risks through United States Aviation Underwriters, Inc.,

and acts as a business development consultant and reinsurance intermediary through Ardent Risk Services, Inc. General

Re also operates as a dealer in the swap and derivatives market through General Re Financial Products Corporation, and

provides specialized investment services to the insurance industry through General Re-New England Asset Management,

Inc.

Each of the business acquisitions described above was accounted for under the purchase method. The excess of the

purchase cost of the business over the fair value of net assets acquired was recorded as goodwill of acquired businesses.

The aggregate goodwill associated with the three acquisitions discussed above was $15.5 billion, including $14.5 billion

associated with the General Re merger.

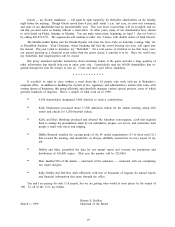

The results of operations for each of these entities are included in Berkshire’s consolidated results of operations from

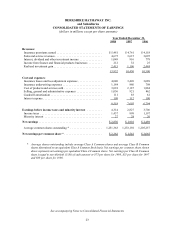

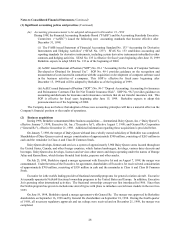

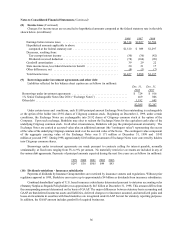

the dates of each merger. The following table sets forth certain consolidated earnings data for the years ended December

31, 1998 and 1997, as if the Dairy Queen, Executive Jet and General Re acquisitions had been consummated on the same

terms at the beginning of 1997. Dollars in millions except per share amounts.

1998 1997

Insurance premiums earned ............................................... $11,395 $11,369

Sales and service revenues ................................................ 5,267 4,719

Total revenues ......................................................... 24,174 19,422

Net earnings .......................................................... 4,764 2,438

Earnings per equivalent Class A Common Share ............................... 3,137 1,607

In 1996, Berkshire consummated mergers with GEICO Corporation ("GEICO") and FlightSafety International,

Inc. ("FlightSafety"). Additional information concerning each merger is provided below.

On January 2, 1996, GEICO became a wholly-owned subsidiary of Berkshire. GEICO, through its subsidiaries, is

a multiple line property and casualty insurer, the principal business of which is underwriting private passenger automobile

insurance. Pursuant to the GEICO merger agreement, each issued and outstanding common share of GEICO, except shares

held by Berkshire subsidiaries and GEICO, was converted into the right to receive $70 per share, or an aggregate amount

of $2.3 billion. As of the merger date, subsidiaries of Berkshire owned 34,250,000 common shares of GEICO, which were

acquired prior to 1981 at an aggregate cost of $45.7 million. Up to the merger date, neither Berkshire nor its subsidiaries

had acquired any shares of GEICO common stock since 1980. However, Berkshire's ownership percentage, due to

intervening stock repurchases by GEICO, gradually increased from about 33% in 1980 to almost 51% immediately prior

to the merger date.

On December 23, 1996, FlightSafety became a wholly-owned subsidiary of Berkshire. FlightSafety provides high

technology training to operators of aircraft and ships throughout the world. Pursuant to the FlightSafety merger agreement

aggregate consideration of approximately $1.5 billion was paid to FlightSafety shareholders consisting of $769 million in

cash and the remainder in Class A and Class B Common Stock.