Berkshire Hathaway 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

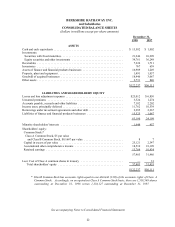

BERKSHIRE HATHAWAY INC.

and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 1998

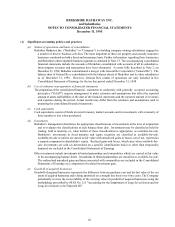

(1) Significant accounting policies and practices

(a) Nature of operations and basis of consolidation

Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in

a number of diverse business activities. The most important of these are property and casualty insurance

businesses conducted on both a direct and reinsurance basis. Further information regarding these businesses

and Berkshire's other reportable business segments is contained in Note 15. The accompanying consolidated

financial statements include the accounts of Berkshire consolidated with accounts of all its subsidiaries.

Intercompany accounts and transactions have been eliminated. As more fully described in Note 2, on

December 21, 1998, Berkshire consummated a merger with General Re Corporation (“General Re”). The

balance sheet of General Re is consolidated with the balance sheets of Berkshire and its other subsidiaries

as of December 31, 1998. However, General Re’s results of operations are only included in th e

Consolidated Statement of Earnings for the ten day period ended December 31, 1998.

(b) Use of estimates in preparation of financial statements

The preparation of the consolidated financial statements in conformity with generally accepted accounting

principles ("GAAP") requires management to make estimates and assumptions that affect the reported

amount of assets and liabilities at the date of the financial statements and the reported amount of revenues

and expenses during the period. Actual results may differ from the estimates and assumptions used in

preparing the consolidated financial statements.

(c) Cash equivalents

Cash equivalents consist of funds invested in money market accounts and in investments with a maturity of

three months or less when purchased.

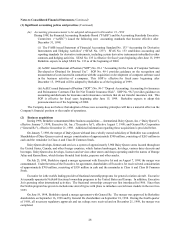

(d) Investments

Berkshire’s management determines the appropriate classifications of investments at the time of acquisition

and re-evaluates the classifications at each balance sheet date. Investments may be classified as held for

trading, held to maturity, or, when neither of those classifications is appropriate, as available-for-sale.

Berkshire’s investments in fixed maturity and equity securities are classified as available-for-sale.

Available-for-sale securities are stated at fair value with unrealized gains or losses, net of tax, reported as

a separate component in shareholders’ equity. Realized gains and losses, which arise when available-for-

sale investments are sold (as determined on a specific identification basis) or other than temporarily

impaired are included in the Consolidated Statements of Earnings.

Other investments include investments in limited partnerships and commodities which are carried at fair value

in the accompanying balance sheets. Investments in limited partnerships are classified as available-for-sale.

The realized and unrealized gains and losses associated with commodities are included in the Consolidated

Statements of Earnings as a component of realized investment gain.

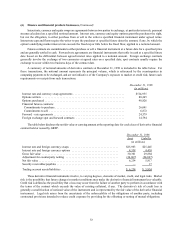

(e) Goodwill of acquired businesses

Goodwill of acquired businesses represents the difference between purchase cost and the fair value of the net

assets of acquired businesses and is being amortized on a straight line basis over forty years. The Company

periodically reviews the recoverability of the carrying value of goodwill of acquired businesses using the

methodology prescribed by SFAS No. 121 "Accounting for the Impairment of Long-Lived Assets and for

Long-Lived Assets to be Disposed Of."