Berkshire Hathaway 1998 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

the earnings of our “seasoned” book, meaning policies that have been with us for more than a year. The other 50% is

tied to growth in policyholders — and here we have stepped on the gas.

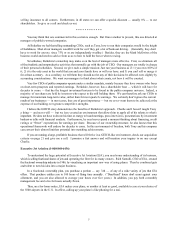

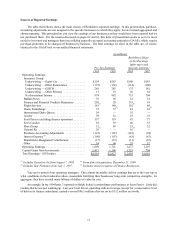

In 1995, the year prior to its acquisition by Berkshire, GEICO spent $33 million on marketing and had 652

telephone counselors. Last year the company spent $143 million, and the counselor count grew to 2,162. The effects

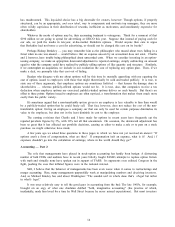

that these efforts had at the company are shown by the new business and in-force figures below:

New Auto Auto Policies

Years Policies* In-Force*

1993 1,354,882 2,011,055

1994 1,396,217 2,147,549

1995 1,461,608 2,310,037

1996 1,617,669 2,543,699

1997 1,913,176 2,949,439

1998 1,317,761 3,562,644

* “Voluntary” only; excludes assigned risks and the like.

In 1999, we will again increase our marketing budget, spending at least $190 million. In fact, there is no limit to

what Berkshire is willing to invest in GEICO’s new-business activity, as long as we can concurrently build th e

infrastructure the company needs to properly serve its policyholders.

Because of the first-year costs, companies that are concerned about quarterly or annual earnings would shy from

similar investments, no matter how intelligent these might be in terms of building long-term value. Our calculus is

different: We simply measure whether we are creating more than a dollar of value per dollar spent — and if that

calculation is favorable, the more dollars we spend the happier I am.

There is far more to GEICO’s success, of course, than low prices and a torrent of advertising. The handling o f

claims must also be fair, fast and friendly — and ours is. Here’s an impartial scorecard on how we shape up: In New

York, our largest-volume state, the Insurance Department recently reported that GEICO’s complaint ratio in 1997 was

not only the lowest of the five largest auto insurers but was also less than half the average of the other four.

GEICO’s 1998 profit margin of 6.7% was better than we had anticipated — and, indeed, better than we wished.

Our results reflect an industry-wide phenomenon: In recent years, both the frequency of auto accidents and their severity

have unexpectedly declined. We responded by reducing rates 3.3% in 1998, and we will reduce them still more in 1999.

These moves will soon bring profit margins down — at the least to 4%, which is our target, and perhaps considerably

lower. Whatever the case, we believe that our margins will continue to be much better than those of the industry.

With GEICO’s growth and profitability both outstanding in 1998, so also were its profit-sharing and bonu s

payments. Indeed, the profit-sharing payment of $103 million or 32.3% of salary — which went to all 9,313 associates

who had been with us for more than a year — may well have been the highest percentage payment at any large company

in the country. (In addition, associates benefit from a company-funded pension plan.)

The 32.3% may turn out to be a high-water mark, given that the profitability component in our profit-sharing

calculation is almost certain to come down in the future. The growth component, though, may well increase. Overall,

we expect the two benchmarks together to dictate very significant profit-sharing payments for decades to come. For our

associates, growth pays off in other ways as well: Last year we promoted 4,612 people.

Impressive as the GEICO figures are, we have far more to do. Our market share improved significantly in 1998

— but only from 3% to 3½%. For every policyholder we now have, there are another ten who should be giving us their

business.

Some of you who are reading this may be in that category. About 40% of those who check our rates find that they

can save money by doing business with us. The proportion is not 100% because insurers differ in their underwriting

judgements, with some giving more credit than we do to drivers who live in certain geographical areas or work at certain

occupations. We believe, however, that we more frequently offer the low price than does any other national carrier