Berkshire Hathaway 1998 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

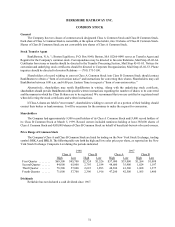

BERKSHIRE HATHAWAY INC.

INSURANCE GROUP

Berkshire's insurance businesses are comprised of four operating groups of

subsidiaries. GEICO Corporation ("GEICO"), currently the sixth largest auto

insurer in the U.S., was merged with another Berkshire subsidiary at the

beginning of 1996. Prior to that date, Berkshire subsidiaries owned approximately

51% of the then outstanding capital stock of GEICO. GEICO, through its

subsidiaries, is a multiple line property and casualty insurer the principal business

of which is writing private passenger automobile insurance. GEICO's voluntary

auto policy count grew 21% during the twelve months ended December 31, 1998.

At the same time, outstanding underwriting results continued to be generated.

The Berkshire Hathaway Reinsurance Division provides treaty and limited

facultative reinsurance to other property/casualty insurers and reinsurers.

Berkshire is one of the world's leading providers of catastrophe excess of loss

reinsurance. Berkshire's unparalled capital strength has enabled it to offer dollar

coverages of a magnitude far in excess of its competitors.

Berkshire's third group of businesses underwrite miscellaneous forms of direct

insurance. National Indemnity Company and other affiliated entities underwrite

multiple lines of traditional insurance for primarily commercial accounts. The

"Homestate Group" companies underwrite various commercial coverages for risks

in an increasing number of selected states. Cypress Insurance Company provides

workers' compensation insurance to employers in California and other states.

Central States Indemnity Company issues credit insurance distributed through

credit card issuers nationwide and Kansas Bankers Surety Company is an insurer

for primarily small and medium sized banks located in the midwest.

On December 21, 1998, Berkshire completed its acquisition of General Re

Corporation. General Re is a holding company for global reinsurance and related

risk management operations. General Re, through its domestic subsidiaries,

General Reinsurance Corporation and National Reinsurance Corporation, is one

of the largest professional property/casualty reinsurance group domiciled in the

United States. General Re also owns a controlling interest in Cologne Re, a major

international reinsurer.

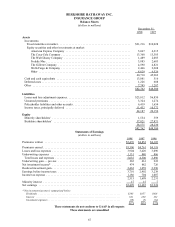

Berkshire Hathaway’s insurance businesses maintains capital strength a t

unparalleled high levels. Statutory surplus as regards policyholders of these

businesses increased to about $45 billion at December 31, 1998.

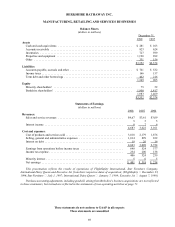

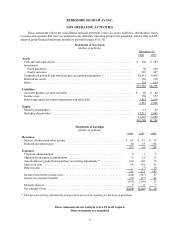

Combined financial statements of the Insurance Group — unaudited and not

fully adjusted to conform to Generally Accepted Accounting Principles — are

presented on the following page. These combined financial statements include

the assets and liabilities of General Re’s insurance operations as of December 31,

1998 but exclude the operating results of General Re from 1998's Statement of

Earnings.