Berkshire Hathaway 1998 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Management's Discussion (Continued)

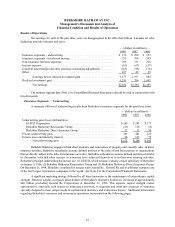

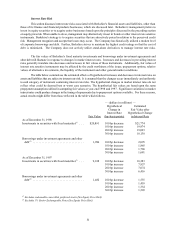

Interest Rate Risk

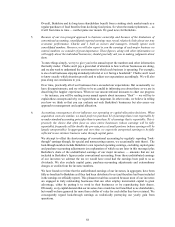

This section discusses interest rate risks associated with Berkshire’s financial assets and liabilities, other than

those of its finance and financial products businesses, which are discussed later. Berkshire's management prefers to

invest in equity securities or to acquire entire businesses based upon the principles discussed in the preceding section

on equity price risk. When unable to do so, management may alternatively invest in bonds or other interest rate sensitive

instruments. Berkshire's strategy is to acquire securities that are attractively priced in relation to the perceived credit

risk. Management recognizes and accepts that losses may occur. The Company has historically utilized a modest level

of corporate borrowings and debt. Further, Berkshire strives to maintain the highest credit ratings so that the cost of

debt is minimized. The Company does not actively utilize stand-alone derivatives to manage interest rate risks.

The fair values of Berkshire's fixed maturity investments and borrowings under investment agreements and

other debt will fluctuate in response to changes in market interest rates. Increases and decreases in prevailing interest

rates generally translate into decreases and increases in fair values of those instruments. Additionally, fair values of

interest rate sensitive instruments may be affected by the credit worthiness of the issuer, prepayment options, relative

values of alternative investments, the liquidity of the instrument and other general market conditions.

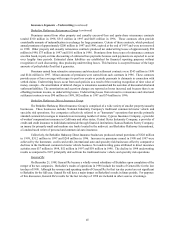

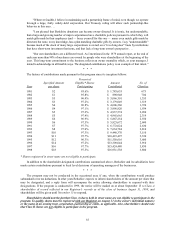

The table below summarizes the estimated effects of hypothetical increases and decreases in interest rates on

assets and liabilities that are subject to interest rate risk. It is assumed that the changes occur immediately and uniformly

to each category of instrument containing interest rate risks. The hypothetical changes in market interest rates do not

reflect what could be deemed best or worst case scenarios. The hypothetical fair values are based upon the same

prepayment assumptions utilized in computing fair values at year-end 1998 and 1997. Significant variations in market

interest rates could produce changes in the timing of repayments due to prepayment options available. For these reasons,

actual results might differ from those reflected in the table which follows.

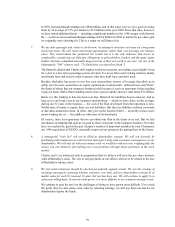

— (dollars in millions) —

Hypothetical Estimated

Change in Fair Value after

Interest Rate Hypothetical Change

Fair Value (bp=basis points) in Interest Rate

As of December 31, 1998

Investments in securities with fixed maturities ...

(1) $20,891 100 bp decrease $21,774

100 bp increase 19,974

200 bp increase 19,093

300 bp increase 18,130

Borrowings under investment agreements and other

debt ..................................

(2) 1,986 100 bp decrease 2,095

100 bp increase 1,865

200 bp increase 1,768

300 bp increase 1,681

As of December 31, 1997

Investments in securities with fixed maturities ...

(1) 9,018 100 bp decrease 10,283

100 bp increase 7,857

200 bp increase 7,074

300 bp increase 6,416

Borrowings under investment agreements and other

debt ..................................

(2) 1,482 100 bp decrease 1,535

100 bp increase 1,410

200 bp increase 1,354

300 bp increase 1,303

Excludes redeemable convertible preferred stocks (See Equity Price Risk)

(1)

Excludes 1% Senior Exchangeable Notes (See Equity Price Risk)

(2)