Berkshire Hathaway 1998 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

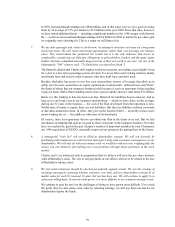

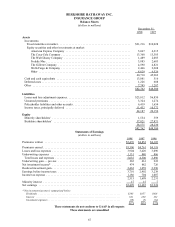

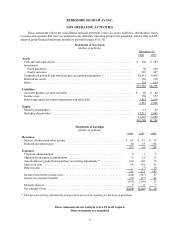

BERKSHIRE HATHAWAY INC.

INSURANCE GROUP

Balance Sheets

(dollars in millions)

December 31,

1998 1997

Assets

Investments:

Fixed maturities at market ................................................ $21,216 $10,028

Equity securities and other investments at market:

American Express Company ........................................... 5,067 4,315

The Coca-Cola Company .............................................. 13,368 13,305

The Walt Disney Company ............................................ 1,489 2,083

Freddie Mac ........................................................ 3,885 2,683

The Gillette Company ................................................ 4,590 4,821

Wells Fargo & Company .............................................. 2,466 2,208

Other ............................................................. 8,629 6,526

60,710 45,969

Cash and cash equivalents ................................................. 13,081 516

Deferred costs ........................................................... 1,226 608

Other ................................................................. 7,745 1,287

$82,762 $48,380

Liabilities

Losses and loss adjustment expenses .......................................... $23,012 $6,850

Unearned premiums ...................................................... 3,324 1,274

Policyholder liabilities and other accruals ...................................... 6,419 1,654

Income taxes, principally deferred ........................................... 11,432 10,372

44,187 20,150

Equity

Minority shareholders’ .................................................... 1,554 359

Berkshire shareholders’ ................................................... 37,021 27,871

38,575 28,230

$82,762 $48,380

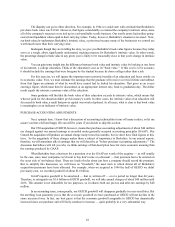

Statements of Earnings

(dollars in millions)

1998 1997 1996

Premiums written ................................................... $5,476 $4,852 $4,105

Premiums earned .................................................... $5,300 $4,761 $4,118

Losses and loss expenses .............................................. 3,904 3,420 3,090

Underwriting expenses ............................................... 1,131 880 806

Total losses and expenses ............................................ 5,035 4,300 3,896

Underwriting gain — pre-tax .......................................... 265 461 222

Net investment income* .............................................. 974 882 726

Realized investment gain .............................................. 2,462 1,059 2,290

Earnings before income taxes .......................................... 3,701 2,402 3,238

Income tax expense .................................................. 1,186 704 1,007

2,515 1,698 2,231

Minority interest .................................................... 17 15 7

Net earnings ....................................................... $2,498 $1,683 $2,224

* Net investment income is summarized below:

Dividends ............................................................ $363 $457 $418

Interest .............................................................. 621 430 322

Investment expenses ..................................................... (10) (5) (14)

$974 $882 $726

These statements do not conform to GAAP in all respects

These statements are unaudited