Berkshire Hathaway 1998 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Today, Berkshire has an unusually large number of individuals, such as Ralph, who are truly legends in their

industries. Many of these joined us when we purchased their companies, but in recent years we have also identified a

number of strong managers internally. We further expanded our corps of all-stars in an important way when we acquired

General Re and EJA.

Charlie and I have the easy jobs at Berkshire: We do very little except allocate capital. And, even then, we are not

all that energetic. We have one excuse, though: In allocating capital, activity does not correlate with achievement.

Indeed, in the fields of investments and acquisitions, frenetic behavior is often counterproductive. Therefore, Charlie

and I mainly just wait for the phone to ring.

Our managers, however, work very hard — and it shows. Naturally, they want to be paid fairly for their efforts,

but pay alone can’t explain their extraordinary ac complishments. Instead, each is primarily motivated by a vision of just

how far his or her business can go — and by a desire to be the one who gets it there. Charlie and I thank them on your

behalf and ours.

* * * * * * * * * * * *

Additional information about our various businesses is given on pages 39-53, where you will also find our segment

earnings reported on a GAAP basis. In addition, on pages 65-71, we have rearranged Berkshire's financial data into

four segments on a non-GAAP basis, a presentation that corresponds to the way Charlie and I think about the company.

Normally, we follow this section with one on “Look-Through” Earnings. Because the General Re acquisition

occurred near yearend, though, neither a historical nor a pro-forma calculation of a 1998 number seems relevant. We

will resume the look-through calculation in next year’s report.

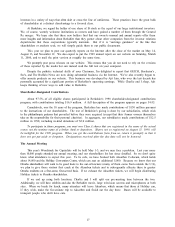

Investments

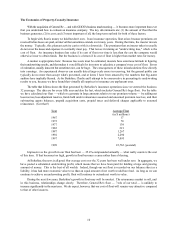

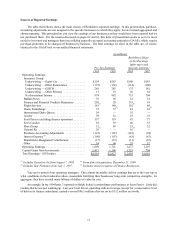

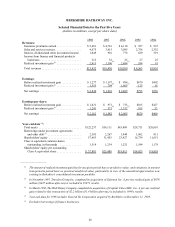

Below we present our common stock investments. Those with a market value of more than $750 million are

itemized.

12/31/98

Shares Company Cost* Market

(dollars in millions)

50,536,900 American Express Company ................................ $1,470 $ 5,180

200,000,000 The Coca-Cola Company ................................... 1,299 13,400

51,202,242 The Walt Disney Company ................................. 281 1,536

60,298,000 Freddie Mac ............................................ 308 3,885

96,000,000 The Gillette Company ..................................... 600 4,590

1,727,765 The Washington Post Company .............................. 11 999

63,595,180 Wells Fargo & Company ................................... 392 2,540

Others ................................................. 2,683 5,135

Total Common Stocks ..................................... $ 7,044 $ 37,265

* Represents tax-basis cost which, in aggregate, is $1.5 billion less than GAAP cost.

During the year, we slightly increased our holdings in American Express, one of our three largest

commitments, and left the other two unchanged. However, we trimmed or substantially cut many of our smaller

positions. Here, I need to make a confession (ugh): The portfolio actions I took in 1998 actually decreased our

gain for the year. In particular, my decision to sell McDonald’s was a very big mistake. Overall, you would have

been better off last year if I had regularly snuck off to the movies during market hours.