Berkshire Hathaway 1998 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

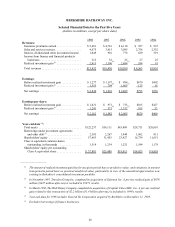

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting polices and practices (Continued)

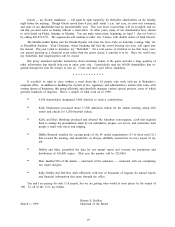

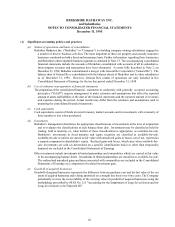

(m) Accounting pronouncements to be adopted subsequent to December 31, 1998

During 1998, the Financial Accounting Standards Board (“FASB”) and the Accounting Standards Executive

Committee (“AcSEC”) issued the following new accounting standards that become effective after

December 31, 1998:

(i) The FASB issued Statement of Financial Accounting Standard No. 133 “Accounting for Derivative

Instruments and Hedging Activities” (“SFAS No. 133"). SFAS No. 133 establishes accounting and

reporting standards for derivative instruments, including certain derivative instruments imbedded in other

contracts, and hedging activities. SFAS No. 133 is effective for fiscal years beginning after June 15, 1999

Berkshire expects to adopt SFAS No. 133 as of the beginning of 2000.

(ii) AcSEC issued Statement of Position (“SOP”) No. 98-1 “Accounting for the Costs of Computer Software

Developed or Obtained for Internal Use”. SOP No. 98-1 provides guidance on the recognition and

measurement of costs incurred in connection with the acquisition or development of computer software used

in the business activities of a company. This SOP is effective for fiscal years beginning after

December 15, 1998 and will be adopted by Berkshire as of the beginning of 1999.

(iii) AcSEC issued Statement of Position (“SOP”) No. 98-7 “Deposit Accounting: Accounting for Insurance

and Reinsurance Contracts That Do Not Transfer Insurance Risk”. SOP No. 98-7 provides guidance on

accounting and disclosure for insurance and reinsurance contracts that do not transfer insurance risk. This

SOP is effective for fiscal years beginning after June 15, 1999. Berkshire expects to adopt this

pronouncement as of the beginning of 2000.

The Company does not believe that adoption of these new accounting principles will have a material effect on the

Company’s financial position or the results of operations.

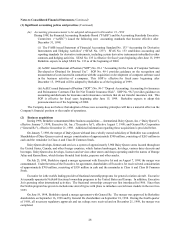

(2) Business acquisitions

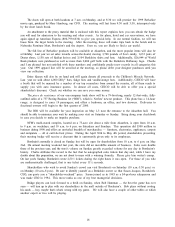

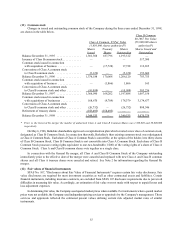

During 1998, Berkshire consummated three business acquisitions — International Dairy Queen, Inc. (“Dairy Queen”),

effective January 7, 1998; Executive Jet, Inc. (“Executive Jet”), effective August 7, 1998; and General Re Corporation

(“General Re”), effective December 21, 1998. Additional information regarding these acquisitions is provided below.

On January 7, 1998, the merger of Dairy Queen with and into a wholly owned subsidiary of Berkshire was completed.

Shareholders of Dairy Queen received merger consideration of approximately $590 million, consisting of $265 million in

cash and the remainder in Class A and Class B Common Stock.

Dairy Queen develops, licenses and services a system of approximately 5,900 Dairy Queen stores located throughout

the United States, Canada, and other foreign countries, which feature hamburgers, hot dogs, various dairy desserts and

beverages. Dairy Queen also develops, licenses and services other stores and shops operating under the names of Orange

Julius and Karmelkorn, which feature blended fruit drinks, popcorn and other snacks.

On July 23, 1998, Berkshire signed a merger agreement with Executive Jet and on August 7, 1998, the merger was

consummated. Under the terms of the Executive Jet agreement, shareholders of Executive Jet received total consideration

of approximately $700 million, consisting of $350 million in cash and the remainder in Class A and Class B Common

Stock.

Executive Jet is the world’s leading provider of fractional ownership progr ams for general aviation aircraft. Executive

Jet currently operates its NetJets® fractional ownership programs in the United States and Europe. In addition, Executive

Jet is pursuing other international activities. The fractional ownership concept was first introduced in 1986. Since then

the NetJets program has grown to include nine aircraft types with plans to introduce several more models in the next two

years.

On June 19, 1998, Berkshire signed a merger agreement with General Re. The merger was approved by Berkshire

shareholders on September 16, 1998 and by General Re shareholders on September 18, 1998. During the fourth quarter

of 1998, all necessary regulatory approvals and tax rulings were received and on December 21, 1998, the merger was

completed.