Berkshire Hathaway 1998 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

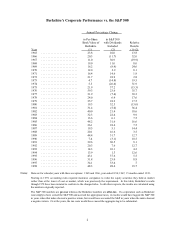

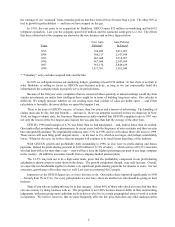

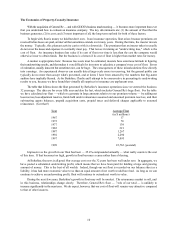

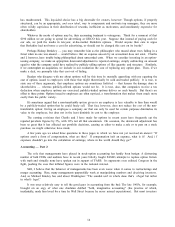

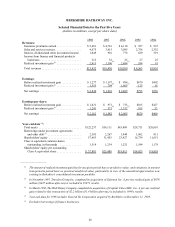

Sources of Reported Earnings

The table that follows shows the main sources of Berkshire's reported earnings. In this presentation, purchase-

accounting adjustments are not assigned to the specific businesses to which they apply, but are instead aggregated and

shown separately. This procedure lets you view the earnings of our businesses as they would have been reported had we

not purchased them. For the reasons discussed on pages 62 and 63, this form of presentation seems to us to be more

useful to investors and managers than one utilizing generally-accepted accounting principles (GAAP), which require

purchase-premiums to be charged off business-by-business. The total earnings we show in the table are, of course,

identical to the GAAP total in our audited financial statements.

(in millions)

Berkshire’s Share

of Net Earnings

(after taxes and

Pre-Tax Earnings minority interests)

1998 1997 1998 1997

Operating Earnings:

Insurance Group:

Underwriting — Super-Cat .................. $154 $283 $100 $183

Underwriting — Other Reinsurance ........... (175)(155)(114)(100)

Underwriting — GEICO .................... 269 281 175 181

Underwriting — Other Primary ............... 17 53 10 34

Net Investment Income ..................... 974 882 731 704

Buffalo News .............................. 53 56 32 33

Finance and Financial Products Businesses ....... 205 28 133 18

Flight Services ............................. 181 140 110 84

(1) (1)

Home Furnishings .......................... 72 57 41 32

(2) (2)

International Dairy Queen .................... 58 — 35 —

Jewelry .................................. 39 32 23 18

Scott Fetzer (excluding finance operation) ........ 137 119 85 77

See’s Candies ............................. 62 59 40 35

Shoe Group ............................... 33 49 23 32

General Re ............................... 26 — 16 —

(3) (3)

Purchase-Accounting Adjustments ............. (123)(101)(118)(94)

Interest Expense ..........................

(4) (100)(107)(63)(67)

Shareholder-Designated Contributions .......... (17)(15)(11)(10)

Other .................................... 34 60 29 37

Operating Earnings .......................... 1,899 1,721 1,277 1,197

Capital Gains from Investments ................. 2,415 1,106 1,553 704

Total Earnings - All Entities ................... $4,314 $2,827 $ 2,830 $1,901

Includes Executive Jet from August 7, 1998 . From date of acquisition, December 21, 1998.

(1) (3)

Includes Star Furniture from July 1, 1997. Excludes interest expense of Finance Businesses.

(2) (4)

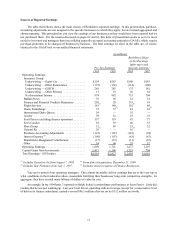

You can be proud of our operating managers. They almost invariably deliver earnings that are at the very top of

what conditions in their industries allow, meanwhile fortifying their businesses’ long-term competitive strengths. I n

aggregate, they have created many billions of dollars of value for you.

An example: In my 1994 letter, I reported on Ralph Schey’s extraordinary performance at Scott Fetzer. Little did

I realize that he was just warming up. Last year Scott Fetzer, operating with no leverage (except for a conservative level

of debt in its finance subsidiary), earned a record $96.5 million after-tax on its $112 million net worth.