Berkshire Hathaway 1998 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

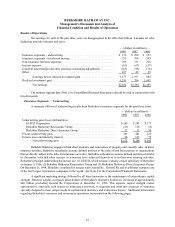

Management's Discussion (Continued)

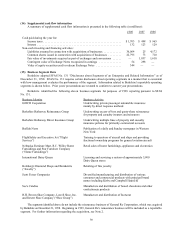

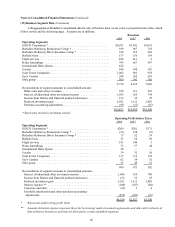

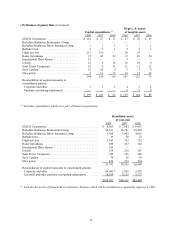

Non-Insurance Business Segments (continued)

Buffalo News

The Buffalo News revenues were relatively unchanged in 1998 as compared to 1997. Operating profits in

1998 of $53 million decreased $3 million (5.4%) from the comparable 1997 amount. Much of the decrease arose as

a result of a special non recurring charge related to workers’ compensation insurance. Without the charge, operating

profits in 1998 would have been comparable to the prior year.

Flight Services

This segment includes FlightSafety and Executive Jet. FlightSafety, acquired at the end of 1996, provides

high technology training to operators of aircraft and ships. FlightSafety’s worldwide clients include corporations, the

military and government agencies. On August 7, 1998, Berkshire acquired Executive Jet, the worlds’ leading provider

of fractional ownership programs for general aviation aircraft. Executive Jet operates the NetJets® fractional

ownership program in the United States and Europe. Revenues of this segment increased $447 million (108.8%) over

comparable prior year amounts. The acquisition of Executive Jet accounts for about 85% of the overall revenue

increase. Operating profits of this segment increased $41 million (29.3%) over comparable prior year amounts. The

acquisition of Executive Jet accounts for about half of the overall increase. FlightSafety’s operating profits increased

significantly over 1997 as a result of continued growth in all areas of its training business.

Home Furnishings

This segment is comprised of three separately managed but similar retail home furnishing businesses:

Nebraska Furniture Mart (“NFM”), based in Omaha, Nebraska; R.C. Willey Home Furnishings (“Willey”), based in

Salt Lake City, Utah; and Star Furniture Company (“Star”), based in Houston, Texas. Berkshire acquired NFM in

1983, Willey in 1995 and Star in 1997. Revenues of this segment increased $126 million (18.9%) as compared to the

prior year. Over half of this increase resulted from the acquisition of Star in July 1997. Both NFM and Willey also

reported strong increases in revenues in 1998 as compared to 1997. Operating profits of $72 million in 1998 increased

$15 million (26.3%) over the comparable prior year amount. Star’s in clusion in this segment’s results, for the full year

of 1998 versus only the last half of 1997, accounts for over half of the comparative increase. The remainder of the

increase arose primarily from increased sales and improved margins at NFM and Willey.

International Dairy Queen

At the beginning of 1998, Berkshire completed the acquisition of Dairy Queen. Dairy Queen develops,

licenses and services a system of approximately 5,900 Dairy Queen stores located throughout the United States, Canada

and other foreign countries. Dairy Queen stores feature hamburgers, hot dogs, various dairy desserts and beverages.

Dairy Queen also develops, licenses and services other stores and shops operating under the names of Orange Julius

and Karmel Korn which feature blended fruit drinks, popcorn and other snacks. Dairy Queen’s results for 1998 were

in line with management’s plan and continued positive results are expected from this business.

Jewelry

This segment consists of two separately managed retailers of fine jewelry. Borsheim’s operates from a single

location in Omaha, Nebraska. Helzberg’s Diamonds operates a national chain of retail stores located primarily i n

malls throughout the United States. Revenues of $440 million increased $42 million (10.6%) and operating profits

of $39 million increased $7 million (21.9%) over the comparable prior year amounts. While the revenue increase

accounted for much of the increase in operating profits, both of these businesses were able to effectively control

operating expenses resulting in improved results.

Scott Fetzer Companies

The Scott Fetzer companies are a group of about twenty diverse manufacturing and distribution businesses

under common management. Principal businesses in this group of companies sell products under the Kirby (home

cleaning systems), Campbell Hausfeld (air compressors, paint sprayers and pressure washers) and World Book

(encyclopedias and other educational products) names. Revenues of $1,002 million increased $41 million (4.3%) over

the comparable prior year amount.