Berkshire Hathaway 1998 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

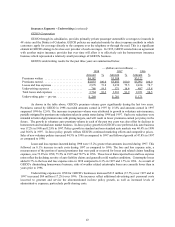

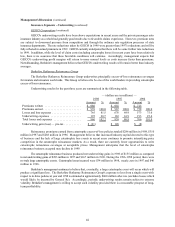

Management's Discussion (continued)

Insurance Segments - Underwriting (continued)

General Re (continued)

General Re and its affiliates operate a global insurance/reinsurance business with operations in the U.S. and

124 other countries around the world. General Re’s principal reinsurance operations are internally classified: (1 )

North American property/casualty, (2) international property/casualty, and (3) global life/health reinsurance.

North American property/casualty operations underwrite predominantly excess-of-loss reinsurance across

various lines of business. The international property/casualty operations write quota-share and excess-of-loss

reinsurance for risks throughout the world. The global life/health operations reinsure such risks in North America

and throughout the world. The international property/casualty and global life/health businesses are primarily

conducted through German-based Cologne Re and its subsidiaries. As of December 31, 1998, General Re, directly

and indirectly through a joint venture arrangement, maintained an 82% economic interest in Cologne Re.

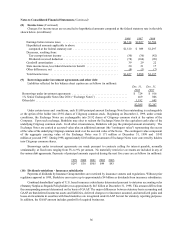

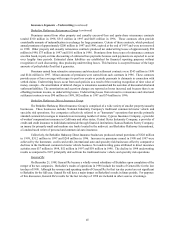

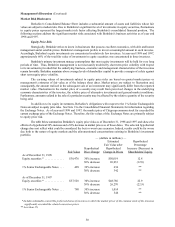

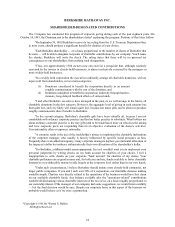

Summarized information regarding General Re’s historical pre-tax underwriting results for 1998 and 1997

is presented below.

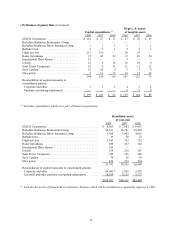

— (dollars in millions) —

Net premiums earned Net underwriting gain (loss)

1998 1997 1998 1997

North American property/casualty ............. $2,708 $3,143 $ (15) $ 23

International property/casualty ............... 2,095 2,270 (112) (55)

Global life/health .......................... 1,292 1,193 (282)* 13

$6,095 $6,606 $(409) $ (19)

* Includes a pre-tax loss of $275 million related to estimated losses incurred by a Cologne Re U.S. based life insurance

subsidiary. Such losses were incurred with respect to U.S. workers’ compensation reinsurance written through an

underwriting facility in the London market.

General Re’s historical pre-tax net investment income in each of the years ending December 31, 1998 and

1997 totaled approximately $1.3 billion. On an after-tax basis, General Re’s historical net investment income was

about $975 million in both 1998 and 1997.

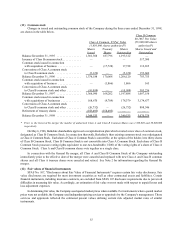

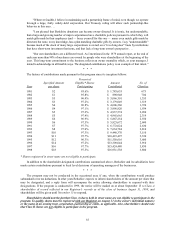

Insurance Segments - Investment Income

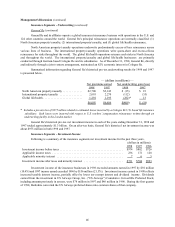

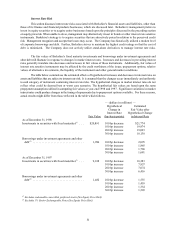

Following is a summary of the insurance segments net investment income for the past three years.

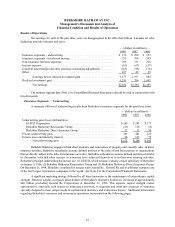

(dollars in millions)

1998 1997 1996

Investment income before taxes .......................................... $974 $882 $726

Applicable income taxes ............................................... 236 172 128

Applicable minority interest ............................................ 7 6 5

Investment income after taxes and minority interest .......................... $731 $704 $593

Investment income of the insurance businesses in 1998 exceeded amounts earned in 1997 by $92 million

(10.4%) and 1997 income earned exceeded 1996 by $156 million (21.5%). Investment income earned in 1998 reflects

increased taxable interest income, partially offset by lower tax-exempt interest and dividend income. Dividends

earned from the investment in US Airways Group, Inc. ("US Airways") Cumulative Convertible Preferred Stock,

including amounts previously in arrears, were $78 million in 1997 and $46 million in 1996. During the first quarter

of 1998, Berkshire converted the US Airways preferred shares into common shares of that company.