Berkshire Hathaway 1998 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Notes to Consolidated Financial Statements (Continued)

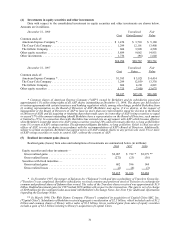

(6) Finance and financial products businesses

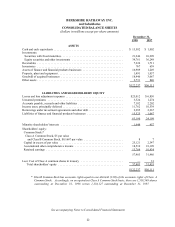

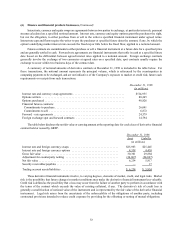

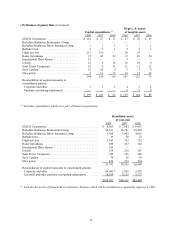

Assets and liabilities of Berkshire's finance and financial products businesses are summarized below (in millions).

Amounts as of December 31, 1998 include the financial products business of General Re, which merged with Berkshire

on December 21, 1998. See Note 2.

1998 1997

Assets

Cash and cash equivalents .................................................. $16,907 $16,56

Investment in securities with fixed maturities:

Held to maturity, at cost (fair value $1,366 in 1998; $1,082 in 1997) ................ 1,227 971

Trading, at fair value (cost $5,279) .......................................... 5,219 —

Available for sale, at fair value (cost $745) .................................... 743 —

Trading account assets ..................................................... 6,234 —

Securities purchased under agreements to resell .................................. 1,083 —

Other .................................................................. 1,576 222

$16,989 $1,249

Liabilities

Annuity reserves and policyholder liabilities .................................... $16,816 $1,697

Securities sold under agreements to repurchase .................................. 4,065 —

Securities sold but not yet purchased .......................................... 1,181 —

Trading account liabilities .................................................. 5,834 —

Notes payable and other borrowings* ......................................... 1,503 326

Other .................................................................. 2,126 44

$15,525 $1,067

*Payments of principal amounts of notes payable and other borrowings during the next five years are as follows (in millions):

1999 2000 2001 2002 2003

$341 $2 $112 $268 $466

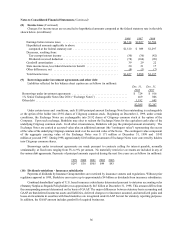

Berkshire’s finance and financial products businesses consist primarily of the financial products businesses of General

Re, the finance business of Scott Fetzer Financial Group and a life insurance subsidiary in the business of selling annuities.

General Re’s financial products businesses consist of General Re Financial Products (“GRFP”) group and a collection of other

businesses that provide investment, insurance, reinsurance and real estate management and brokerage services. Significant

accounting policies and disclosures for these businesses are as follows:

Investment securities (principally fixed maturity and equity investments) that are acquired for purposes of selling them

in the near term are classified as trading securities. Such assets are carried at fair value. Realized and unrealized gains and

losses from trading activities are included in income from finance and financial products businesses. Trading account assets

and liabilities are marked-to-market on a daily basis and represent the estimated fair values of derivatives in net gain

positions (assets) and in net loss positions (liabilities). The net gains and losses reflect reductions permitted under master

netting agreements with counterparties.

Securities purchased under agreements to resell (assets) and securities sold under agreements to repurchase (liabilities)

are accounted for as collateralized investments and borrowings and are recorded at the contractual resale or repurchase

amounts plus accrued interest. Other investment securities owned and liabilities associated with investment securities sold

but not yet purchased are carried at fair value.

GRFP is engaged as a dealer in various types of derivative instruments, including interest rate, currency and equity

swaps and options, as well as structured finance products. These instruments are carried at their current estimates of fair

value, which is a function of underlying interest rates, currency rates, security values, volatilities and the creditworthiness

of counterparties. Future changes in these factors or a combination thereof may affect the fair value of these instruments with

any resulting adjustment to be included currently in the Statement of Earnings.