Berkshire Hathaway 1998 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Notes to Consolidated Financial Statements (Continued)

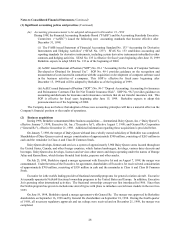

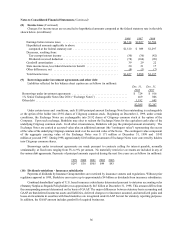

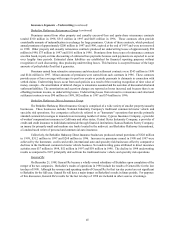

(12) Fair values of financial instruments (Continued)

Considerable judgement is necessarily required in interpreting market data used to develop the estimates of fair value.

Accordingly, the estimates presented herein are not necessarily indicative of the amounts the Company could realize in a

current market exchange. The use of different market assumptions and/or estimation methodologies may have a material effect

on the estimated fair value.

The carrying values of cash and cash equivalents, receivables and accounts payable, accruals and other liabilities are

deemed to be reasonable estimates of their fair values. The estimated fair values of the Company's other financial

instruments as of December 31, 1998 and 1997, are as follows (in millions):

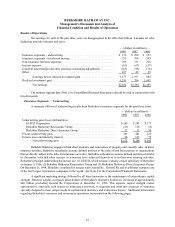

Carrying Value Estimated Fair Value

1998 1997 1998 1997

Investments in securities with fixed

maturities .......................................... $21,246 $10,298 $21,246 $10,298

Investments in equity securities and other investments ......... 39,761 36,248 39,761 36,248

Assets of finance and financial products businesses ............ 16,989 1,249 17,129 1,367

Borrowings under investment agreements and

other debt .......................................... 2,385 2,267 2,475 2,262

Liabilities of finance and financial products businesses ......... 15,525 1,067 15,698 1,149

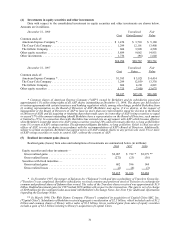

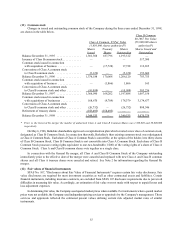

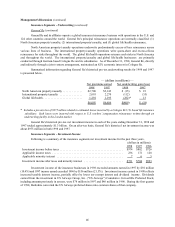

(13) Quarterly data

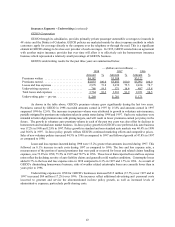

A summary of revenues and earnings by quarter for each of the last two years is presented in the following table. This

information is unaudited. Dollars are in millions, except per share amounts.

1st 2nd 3rd 4th

1998 Quarter Quarter Quarter Quarter

Revenues ........................................... $3,325 $3,936 $2,909 $3,662

Earnings:

Excluding realized investment gain ..................... $ 252 $ 312 $ 264 $ 449

Realized investment gain * ............................ 470 864 101 118

Net earnings ....................................... $ 722 $1,176 $ 365 $ 567

Earnings per equivalent Class A common share:

Excluding realized investment gain ..................... $ 203 $ 251 $ 212 $ 352

Realized investment gain * ............................ 379 696 81 92

Net earnings ....................................... $ 582 $ 947 $ 293 $ 444

1st 2nd 3rd 4th

1997 Quarter Quarter Quarter Quarter

Revenues ........................................... $2,075 $2,338 $2,373 $3,644

Earnings:

Excluding realized investment gain ..................... $ 263 $ 255 $248 $432

Realized investment gain * ............................ 21 23 119 540

Net earnings ....................................... $ 284 $ 278 $ 367 $ 972

Earnings per equivalent Class A common share:

Excluding realized investment gain * .................... $ 214 $ 207 $ 201 $ 350

Realized investment gain ............................. 17 19 96 438

Net earnings ....................................... $ 231 $ 226 $ 297 $ 788

*The amount of realized gain for any given period has not predictive value and variations in amount from period to period

have no practical analytical value particulary in view of the unrealized appreciation now existing in Berkshire’s

consolidated investment portfolio.