Berkshire Hathaway 1998 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

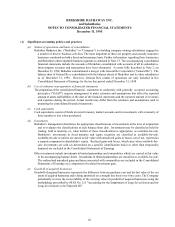

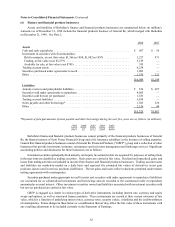

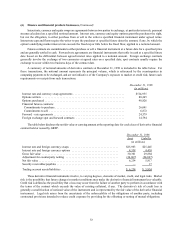

Notes to Consolidated Financial Statements (Continued)

(6) Finance and financial products businesses (Continued)

With respect to Berkshire’s life insurance business, annuity reserves and policy holder liabilities are carried at the present

value of the actuarially determined ultimate payment amounts discounted at market interest rates existing at the inception

of the contracts. Periodic accretions of the discounted liabilities are charged against income from finance and financial

products businesses.

Investments in securities with fixed maturities held by Berkshire’s life insurance business are classified as held-to -

maturity. Investments classified as held-to-maturity are carried at amortized cost reflecting the company’s ability and intent

to hold such investments to maturity. Such items consist predominantly of mortgage loans and collateralized mortgage

obligations.

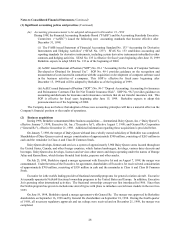

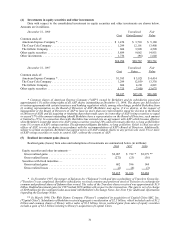

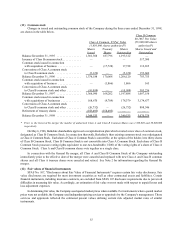

(7) Unpaid losses and loss adjustment expenses

Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance subsidiaries

(in millions) is as follows:

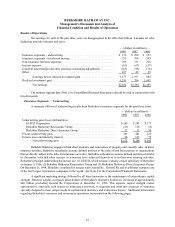

1998 1997 1996

Unpaid losses and loss adjustment expenses:

Balance at beginning of year ...................................... $6,850 $6,274 $5,924

Less ceded liabilities and deferred charges ........................... 754 586 645

Net balance ................................................... 6,096 5,688 5,279

Incurred losses recorded:

Current accident year ........................................... 4,235 3,551 3,179

All prior accident years .......................................... (195) (131) (90)

Total incurred losses ............................................ 4,040 3,420 3,089

Payments with respect to:

Current accident year ........................................... 1,919 1,602 1,485

All prior accident years .......................................... 1,834 1,410 1,195

Total payments ................................................ 3,753 3,012 2,680

Unpaid losses and loss adjustment expenses:

Net balance at end of year ........................................ 6,383 6,096 5,688

Ceded liabilities and deferred charges ............................... 2,727 754 586

Net liabilities assumed in connection with General Re Merger ............ 13,902 — —

Balance at end of year ............................................ $23,012 $6,850 $6,274

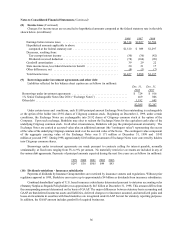

Incurred losses “all prior accident years” reflects the amount of estimation error charged or credited to earnings in each

year with respect to the liabilities established as of the beginning of that year. This amount includes amortization of deferred

charges re reinsurance and accretion of discounted liabilities. See Note 1 for additional information regarding these items.

Additional information regarding incurred losses will be revealed over time and the estimates will be revised

resulting in gains or losses in the periods made.

The balances of unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs

associated with claim occurrences as of the balance sheet dates. Considerable judgement is required to evaluate claims and

establish estimated claim liabilities, particularly with respect to certain lines of business, such as reinsurance assumed, or

certain types of claims, such as environmental or latent injury liabilities.

The Company continuously evaluates its liabilities and related reinsurance recoverable for environmental and latent

injury claims and claim expenses, which arise from exposures in the U.S., as well as internationally. Environmental and

latent injury exposures do not lend themselves to traditional methods of loss development determination and therefore